Ever felt stuck by an unexpected financial crisis? You’re not alone. When life surprises you with a sudden car repair, medical bill, or urgent expense, a fast 200 dollar loan is your lifeline1. The good news is that many options are available to help you quickly and reliably2.

Modern technology has changed how we get emergency funds. Cash advance apps now offer quick solutions for those asking, “Where can I get a 200 dollar loan?” They provide fast financial help, with advances from $200 to $50012.

It’s important to know your options. Whether you need instant cash from mobile apps or traditional lending, there are smart ways to get the funds you need without hurting your finances3.

Key Takeaways: Where Can I Get a 200 Dollar Loan

- Multiple fast loan options exist for $200 emergencies

- Cash advance apps offer quick, accessible funding

- Instant transfers can provide funds within minutes

- No credit check options are available for many borrowers

- Compare fees and repayment terms before choosing

Understanding 200 Dollar Loans and Their Purpose

When money troubles come up, small cash loans can help a lot. It’s easy to find where to get a 200 dollar loan quick lending options are just a few clicks away4.

We've created this table to help you compare different online loan matching services. These services can connect you with a network of lenders, offering various types of loans to fit your needs.

In this table, you'll find key details such as the loan provider's name, the range of loan amounts they can help you find, typical approval and payout speeds, and the types of loans they offer.

To get a complete picture, including details about potential costs like APRs and fees, specific credit requirements, the application process, security information, and other considerations, we encourage you to visit the related service's page directly.

Please remember that these services are not direct lenders, so your specific loan terms will be determined by the actual lender, and those details can vary. Please note that we may receive an affiliate commission if you click on links or apply through this page, however, this does not influence our recommendations.

We hope this comparison table helps you in your search!

Common Reasons for Needing a Small Loan

Life doesn’t always go as planned. Unexpected bills can surprise you, making a 200 dollar loan key for quick fixes5. Here are some common reasons:

- Urgent car repairs

- Medical emergency copays

- Overdue utility bills

- Last-minute travel expenses

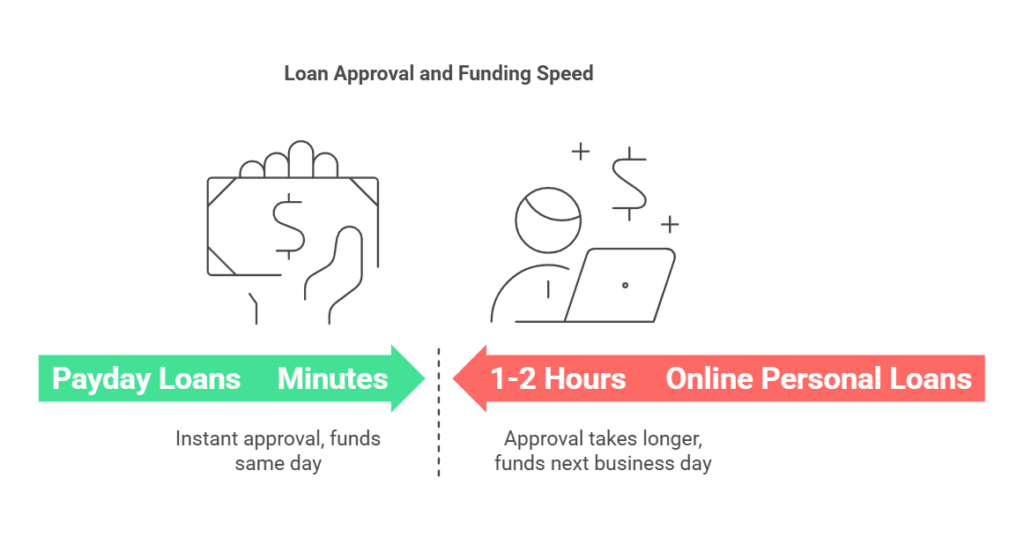

How Fast Can You Get the Money

Small cash loans are fast. Many lenders offer instant approval in minutes, with money in your account the same day4. Online apps make it easy to get a 200 dollar loan from anywhere5.

| Loan Type | Approval Time | Funding Speed |

|---|---|---|

| Payday Loans | Minutes | Same Day |

| Online Personal Loans | 1-2 Hours | Next Business Day |

Basic Requirements for Qualifying

Getting a 200 dollar loan is simple. Lenders usually ask for:

- Age 18 or older

- Steady income source

- Active checking account

- Valid government ID

Even with bad credit, you can still get these loans4.

“Small loans can be your financial safety net when unexpected expenses arise.” – Financial Expert

Knowing where to get a 200 dollar loan depends on understanding your options and meeting basic requirements5.

Where Can I Get a 200 Dollar Loan: Available Options

Getting a 200 dollar loan is easier than you think. You have many ways to get quick cash for unexpected bills through different financial services. Knowing your payday loan options can help you borrow wisely.

Here are your main choices for a quick 200 dollar loan:

- Earned Wage Access: Get money based on your current earnings6

- Cash Advance Apps: Instant funds with minimal requirements6

- Credit Union Loans: More flexible lending criteria7

Payday loan alternatives offer better borrowing experiences. Look at these specific options:

| Lender | Loan Amount | Key Features |

|---|---|---|

| Earnin | Up to $150 daily | No credit check6 |

| Oportun | From $200 | Flexible terms8 |

| Possible Finance | Up to $500 | Quick approval8 |

Pro Tip: Always compare interest rates and repayment terms before choosing a loan. Payday alternatives like credit union loans can have much lower APRs than traditional payday loans7.

Your financial flexibility starts with understanding your borrowing options!

Application Process and Requirements

Getting a 200 dollar loan is easy. Knowing the application steps helps you get the money fast. This is true when looking for where can i get a 200 dollar loan9.

Essential Documentation Needed

Having the right documents is key for a smooth loan experience. You’ll need:

- Valid government-issued ID

- Proof of steady income

- Active bank account details

- Social security number

Loan requirements often ask for a valid ID, proof of income, and a positive bank balance9.

Online Application Steps

- Choose a reputable lender

- Complete online application form

- Upload required documentation

- Wait for instant approval

Most lenders have a quick digital process. 99% of personal loan funds can be sent the next business day after completing required paperwork10.

Processing Time Expectations

| Loan Type | Processing Time | Typical Amount |

|---|---|---|

| Payday Alternative Loans | 24-48 hours | $200-$1,0009 |

| Personal Loans | 1-3 business days | $1,000-$5,00010 |

“Speed is the name of the game when securing a quick 200 dollar loan!” – Financial Expert

Pro tip: Have all your documents ready. This speeds up the where can i get a 200 dollar loan process. It also boosts your chances of instant approval9.

Credit Score Requirements and Approval Chances

Stressed about getting a where can i get a 200 dollar loan with bad credit? Relax! Many lenders get that credit scores don’t tell the whole story11. No-credit-check loans are a big help for those needing quick cash12.

Looking into no credit check 200 dollar loan options? You’ll find many ways to get the money you need:

- Payday loans for fast cash11

- Cash advance apps with flexible borrowing limits11

- Alternative lending platforms with easy requirements12

Quick Insight: Payday loans have an average APR of 400%, so think carefully11. Loan amounts usually range from $100 to $1,000, helping with urgent needs12.

“Your credit score is a number, not your financial destiny.”

| Loan Type | Typical Amount | Credit Check |

|---|---|---|

| Payday Loans | $100-$500 | Minimal/None |

| Cash Advance Apps | $10-$750 | No Hard Check |

| Personal Loans | $1,000-$15,000 | Soft/Hard Check |

While no credit check 200 dollar loan options are available, borrowing wisely is important. Some lenders might report missed payments to credit bureaus11. So, always think about how you’ll pay back the loan.

Alternative Ways to Get 200 Dollars

When traditional borrowing seems tough, think outside the box. There are many ways to get emergency cash advance options. Your financial solution might be closer than you think where can I get a 200 dollar.

Emergency Fund Strategies

Here are some quick ways to get $200:

We've created this table to help you compare different online loan matching services. These services can connect you with a network of lenders, offering various types of loans to fit your needs.

In this table, you'll find key details such as the loan provider's name, the range of loan amounts they can help you find, typical approval and payout speeds, and the types of loans they offer.

To get a complete picture, including details about potential costs like APRs and fees, specific credit requirements, the application process, security information, and other considerations, we encourage you to visit the related service's page directly.

Please remember that these services are not direct lenders, so your specific loan terms will be determined by the actual lender, and those details can vary. Please note that we may receive an affiliate commission if you click on links or apply through this page, however, this does not influence our recommendations.

We hope this comparison table helps you in your search!

- Sell unused items on online marketplaces13

- Explore paycheck advance apps that offer instant funding14

- Request overtime or extra shifts at work

- Participate in online survey platforms

Side Gigs for Quick Cash

The gig economy is full of chances to earn $200 fast. Sites like Fiverr, Upwork, and TaskRabbit help you find freelance work13. You can also make money by driving, delivering food, or doing small tasks.

“Financial creativity transforms obstacles into opportunities” – Financial Freedom Mantra

Community Resources

Local community resources can help with money troubles. Credit unions offer payday alternative loans (PALs) from $200 to $1,000 with easy repayment terms14. Look into local non-profits, churches, and community programs for emergency cash.

When looking for a $200 loan, don’t just stick to one option. Apps can give you money in 30 minutes13. Others might take a bit longer14.

Where Can I Get a 200 Dollar Loan: Conclusion

Your search for a 200 dollar loan has shown you many options. Quick online loans are great for sudden expenses. They offer different choices to fit your needs15. You can find small loans from credit unions or flexible terms online16.

When borrowing, think carefully. Getting a quick online loan helps with immediate needs. But, it’s also important to build a strong financial future. You now know how to choose loans wisely, knowing about APR and what you need to qualify15.

Good financial health is more than quick fixes. Try side hustles, save for emergencies, and learn about loans. Online loans can be approved fast, sometimes in minutes or hours17. Your financial journey is about making smart choices to grow your wealth.

Starting your financial journey with knowledge and planning is key. Whether you need a $200 loan today or want a strong financial future, you’re ready. Your financial freedom starts today.

Frequently Asked Questions About Getting a $200 Loan

Where can I get a $200 loan quickly?

For speed and simplicity, consider cash advance apps like Earnin or Dave, which can offer instant funds. Online lenders specializing in small personal loans can also provide cash within 24 hours. Another option is a payday loan alternative (PAL) from a federal credit union.

Can I get a $200 loan with bad credit?

Yes, absolutely. Many online lenders and cash advance apps don't focus on your credit score but rather on your current income. No-credit-check loans are also available, though often with higher fees. Payday loans are also an option but are very expensive.

How fast can I get a $200 loan online?

Online lenders and cash advance apps often offer same-day funding, sometimes within minutes. You can typically apply from your phone, get instant approval, and receive the money quickly.

Are there alternatives to payday loans for a small amount like $200?

Yes, there are much better alternatives. Look into Payday Alternative Loans (PALs) from federal credit unions, which have lower interest rates and fees than traditional payday loans. Some non-profit organizations also offer microloans.

What are the requirements for getting a $200 loan?

Generally, you'll need a valid ID, proof of income, and an active bank account. Some lenders may require your Social Security number, but many cash advance apps don't perform a credit check.

Is it possible to get a $200 loan if I'm unemployed?

It can be tough, but it's not impossible. Lenders need to see your ability to repay. If you have alternative income sources like benefits, alimony, or a pension, you might still qualify. Some lenders specialize in loans for the unemployed, but you'll need to show proof of this income.

What kind of fees should I expect with a $200 loan?

Fees vary significantly. Cash advance apps might have small membership fees or optional tips. Online lenders can have origination fees or late payment penalties. Payday loans are known for having notoriously high fees and interest rates. Always check the fine print.