Understanding home financing can seem like trying to solve a puzzle. But what if you could use the assets you already own? Asset based mortgage loans offer a new way to own a home, breaking down old lending rules1.

The market for asset utilization loans has grown a lot, with big increases in non-bank lending1. These loans help people with different income sources and assets get the financing they need2. Loan amounts can vary from $50,000 to $2,000,000, fitting many financial plans2.

An asset based mortgage loan looks at your total financial health, not just your income. This helps self-employed people, retirees, and investors who often face tough lending rules2.

Key Takeaways: Asset Based Mortgage Loan

- Asset based loans use your current financial resources

- Loan terms can range from 6 months to 5 years

- No minimum credit score requirements for many lenders

- Potential leverage up to 75% Loan-to-Value

- Quick approval processes available

Understanding Asset Based Mortgage Loans

Asset based lending is a new way to get property funding. It’s different from traditional mortgages. This method lets you use your current financial resources3.

We've created this table to help you compare different online loan matching services. These services can connect you with a network of lenders, offering various types of loans to fit your needs.

In this table, you'll find key details such as the loan provider's name, the range of loan amounts they can help you find, typical approval and payout speeds, and the types of loans they offer.

To get a complete picture, including details about potential costs like APRs and fees, specific credit requirements, the application process, security information, and other considerations, we encourage you to visit the related service's page directly.

Please remember that these services are not direct lenders, so your specific loan terms will be determined by the actual lender, and those details can vary. Please note that we may receive an affiliate commission if you click on links or apply through this page, however, this does not influence our recommendations.

We hope this comparison table helps you in your search!

These loans offer special chances for people with big financial portfolios. They look at your total assets, not just your income4.

Definition and Basic Concepts

An asset based mortgage lets you use your financial assets as collateral. Retirement accounts, investment portfolios, and liquid savings help you get a loan3.

- Up to 70% of retirement account values can be used for loans3

- Bank account values are 100% used in loan calculations3

- These loans have more flexible criteria than traditional mortgages4

How Asset Based Mortgages Differ from Traditional Loans

Asset based lending has big advantages over traditional mortgages. Traditional loans focus on credit scores and income. But asset based lending looks at your overall financial health4.

| Aspect | Traditional Mortgage | Asset Based Mortgage |

|---|---|---|

| Qualification Criteria | Income & Credit Score | Total Asset Value |

| Approval Speed | Weeks | Days |

| Flexibility | Low | High |

Key Features and Benefits

Asset based lending offers great benefits for smart borrowers. You can get funding quickly and with less paperwork. You might also get bigger loans based on your assets4.

Your assets are not just numbers—they’re powerful financial tools waiting to unlock your real estate dreams.

Use your financial strength with asset based lending. It changes how you invest with a modern, flexible mortgage3.

How Asset Based Mortgage Loan Works

Asset based mortgage loans change how you get a loan for property. They use your assets, not just your income, to qualify you5. This means you can use your investments, retirement funds, and savings to get a mortgage.

The process starts with a borrowing base calculation to figure out how much you can borrow. Lenders look at your total assets and decide how much you can borrow based on a percentage of those assets6. This helps people with lots of assets but not the usual income.

“Your assets are not just numbers – they’re your financial passport to property ownership.”

- Retirement accounts become potential loan collateral

- Investment portfolios can boost borrowing power

- Savings accounts contribute to asset-based lending qualification

The benefits are big. These loans offer flexible financing options with good rates and quick approval5. About 77% of people find them easier to get than regular mortgages6.

| Asset Type | Borrowing Potential | Qualification Impact |

|---|---|---|

| Retirement Accounts | High | Strong Positive |

| Investment Portfolios | Medium to High | Significant |

| Liquid Savings | Low to Medium | Moderate |

Knowing how the borrowing base calculation works lets you use your assets wisely. This gives you a chance to get a mortgage in a new way5.

Types of Assets Accepted for Mortgage Qualification

Unlocking your mortgage potential starts with understanding the diverse range of eligible assets for mortgage qualification. Your financial portfolio might be more powerful than you realize when securing a home loan.

When exploring liquid assets for loans, lenders consider multiple financial resources beyond traditional income streams. Let’s dive into the types of assets that can strengthen your mortgage application.

Retirement and Investment Accounts

Your retirement savings aren’t just for future comfort – they can be strategic tools in mortgage qualification. Lenders typically accept the following investment assets:

- 401(k) retirement accounts

- Individual Retirement Accounts (IRAs)

- Brokerage investment portfolios

- Stocks and bond holdings

Bank Accounts and Liquid Assets

Liquid assets play a crucial role in demonstrating financial stability. Here’s a comprehensive breakdown of acceptable bank accounts:

| Asset Type | Qualification Potential |

|---|---|

| Checking Accounts | High liquidity, immediate access |

| Savings Accounts | Stable asset representation |

| Certificates of Deposit (CDs) | Fixed-term, predictable assets |

| Money Market Accounts | Higher interest-bearing options |

Other Eligible Assets

Think beyond traditional financial instruments! Some lenders are creative in asset acceptance:

- Business equity

- Valuable art collections

- High-value collectibles

- Real estate investments

Asset-based lending transforms your entire financial perspective – your assets are more powerful than you ever imagined.

High-net-worth individuals can leverage unique asset combinations to qualify for mortgages7. Angel Oak Mortgage Solutions, for instance, offers specialized non-QM loans designed for borrowers with diverse financial profiles7.

Remember, each lender has different criteria for eligible assets for mortgage qualification. Consulting with a mortgage professional can help you maximize your asset potential8.

Calculating Asset Based Income

Unlock your assets’ potential with new mortgage income strategies. Asset depletion turns your wealth into a mortgage tool9. Lenders now see your assets as a way to qualify for a mortgage10.

The asset depletion process has key steps:

- Identify total liquid assets available

- Determine the asset depletion period (5, 7, or 10 years)

- Divide total assets by selected time frame

- Calculate monthly theoretical income

“Your assets are no longer just sitting idle – they’re working to help you secure your dream home!”

Asset depletion in mortgage income lets people with big assets and non-traditional income qualify9. About 16.6 million self-employed workers could benefit from this9.

| Asset Depletion Period | Qualification Impact |

|---|---|

| 5 Years | Higher monthly income calculation |

| 7 Years | Balanced income projection |

| 10 Years | Lower monthly income calculation |

Pro tip: Talk to mortgage experts in asset-based lending to boost your chances. They can show you how to best use your assets for mortgage income10.

We've created this table to help you compare different online loan matching services. These services can connect you with a network of lenders, offering various types of loans to fit your needs.

In this table, you'll find key details such as the loan provider's name, the range of loan amounts they can help you find, typical approval and payout speeds, and the types of loans they offer.

To get a complete picture, including details about potential costs like APRs and fees, specific credit requirements, the application process, security information, and other considerations, we encourage you to visit the related service's page directly.

Please remember that these services are not direct lenders, so your specific loan terms will be determined by the actual lender, and those details can vary. Please note that we may receive an affiliate commission if you click on links or apply through this page, however, this does not influence our recommendations.

We hope this comparison table helps you in your search!

Asset Based Lending Requirements

Understanding asset based loan qualifications can be tricky. But knowing the key requirements can help you reach your mortgage goals. These loans are a special way for people with a lot of money to become homeowners.

Asset based mortgages look at your wealth, not just your income. Your assets are the main thing lenders check9.

Credit Score Considerations

Asset based lending is more flexible than traditional mortgages. Even though lenders want a credit score of 620, your wealth can help if your credit isn’t perfect9.

Mortgage Documentation Requirements

Having solid mortgage documents is key for getting an asset based loan. You’ll need to show your financial health with:

- Bank statements (12-24 months)

- Investment account statements

- Retirement account balances

- Liquid asset documentation

| Asset Type | Qualification Weight |

|---|---|

| Marketable Securities | High |

| Retirement Accounts | Medium-High |

| Liquid Cash | High |

Property Evaluation Criteria

Lenders check the property’s value and your asset-to-loan ratio. The advance rate depends on many things, like asset type and your financial health11.

Your assets can be the key to unlocking your dream home – strategically presented financial documentation makes all the difference.

Expect flexible terms, like longer repayment periods. These terms are made to fit your financial situation11.

Asset based loan qualifications focus on showing your financial strength. Get your mortgage documents ready well, and you’ll be closer to owning a home9.

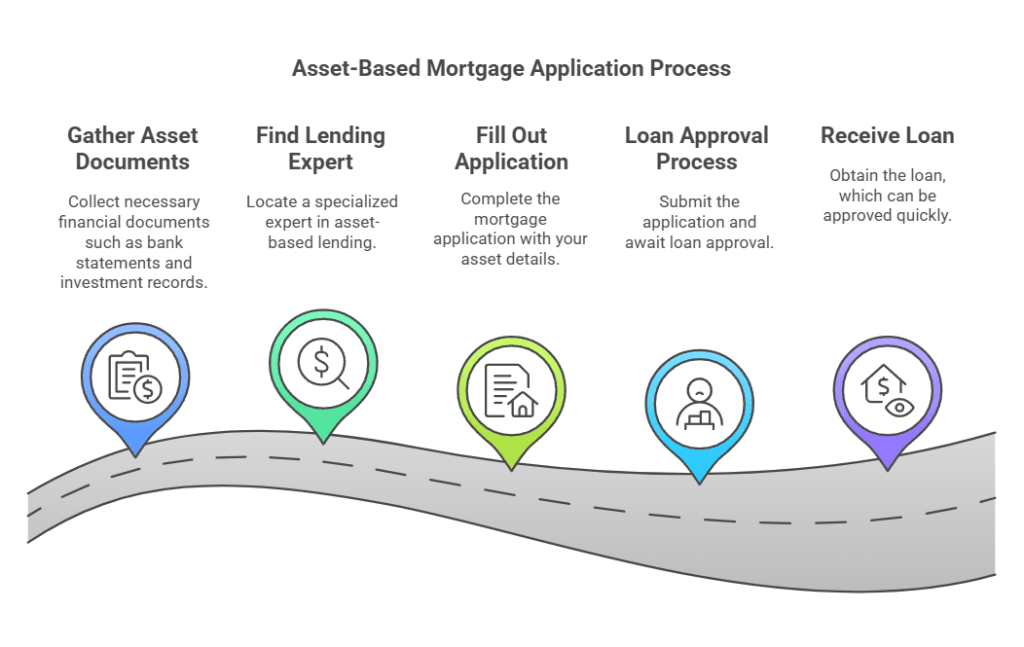

The Application Process

Applying for an asset based mortgage is easier than you think. You’re about to start a simple journey to loan approval, focusing on your financial assets12. This process is easy and uses your current financial resources.

Here are the main steps for your asset based mortgage application:

- Gather all your asset documents

- Bank statements

- Investment portfolio records

- Retirement account balances

- Find a specialized asset-based lending expert

- Fill out the mortgage application with your asset details

Pro Tip: Hard money lenders look at property value, not just credit. This makes loans available even with bad credit12. You could get your loan in just 24 hours after meeting12.

“Your assets are your power – let them work for your mortgage approval.”

Loan amounts vary from $50,000 to $5 million, based on your assets12. Interest rates are between 9% and 15%, with terms from 1 to 2 years12.

Be ready for upfront fees, like appraisal and document costs. But, many lenders have low initial fees, making it easier12.

Borrowing Base Calculation Methods

Understanding borrowing base calculations is key in the world of asset-based mortgages. Your financial path depends on using your assets wisely to get the mortgage you need.

Asset Depletion Formulas: Transforming Your Wealth into Borrowing Power

Asset depletion mortgage strategies turn your liquid assets into a steady income for loan purposes. Lenders look at your total assets and divide them by a monthly period to figure out how much you can borrow13. For example, if you have $600,000 in liquid assets and need a $10,000 monthly mortgage, you might qualify for a 60-month loan13.

Monthly Income Determination

Here’s how to calculate your monthly income through asset depletion:

- Total your liquid financial assets

- Divide total assets by expected loan term

- Verify asset liquidity and accessibility

- Confirm lender-specific asset depletion requirements

“Your assets are not just numbers—they’re potential mortgage fuel.”

Loan-to-Value Considerations

Lenders carefully check loan-to-value ratios in borrowing base calculations. The base borrowing rate, SOFR, is crucial in setting your mortgage terms14. Early 2025 saw SOFR rates around 4.29%, affecting your borrowing capacity14.

| Asset Type | Borrowing Potential | Liquidity Factor |

|---|---|---|

| Retirement Accounts | High | Moderate |

| Investment Portfolios | Medium | High |

| Savings Accounts | High | Very High |

Pro Tip: Smart asset management can boost your borrowing base calculation and mortgage approval chances.

Best Candidates for Asset Based Mortgages

Asset based mortgages are a special kind of loan for certain borrowers. They help those who can’t get traditional mortgages because of income issues15. These loans are great for people with lots of assets but income that’s not steady16.

Ideal borrowers for asset loans include:

- Retirees with big investment portfolios

- Self-employed folks with income that changes a lot

- Those with a lot of money in different assets

- Investors with lots of liquid assets

For those with a lot of money, asset-based lending is a good option. It offers flexibility for those with non-traditional finances.

| Borrower Type | Asset Qualification Potential |

|---|---|

| Retirees | High – Retirement accounts as primary asset |

| Self-Employed Professionals | Moderate to High – Investment portfolios |

| Real Estate Investors | High – Multiple asset streams |

“Your assets can be the key to unlocking your mortgage potential” – Financial Lending Expert

Knowing your financial situation is key when looking at asset-based mortgages. Borrowers should look at their assets and talk to a financial advisor to find the best loan17.

These mortgage options help borrowers who might not get loans from regular banks. They turn asset wealth into chances to buy real estate.

Advantages and Potential Drawbacks

Asset based mortgage loans offer a unique chance for borrowers looking for different financing options. It’s important to know the pros and cons of these loans when looking at mortgage risk assessment strategies12.

Benefits for High-Net-Worth Individuals

High-net-worth individuals can find big benefits in asset based mortgage loans:

- Flexible criteria for qualifying based on asset value18

- Potential for bigger loan amounts

- Lower interest rates than traditional loans12

Limitations and Risks

These loans also have specific risks to think about:

“Know your financial landscape before committing to any loan strategy.”

Cost Considerations

Mortgage risk assessment shows important financial points:

- Interest rates usually fall between 9% and 15%12

- Loan origination fees can be high

- Potential points charged on loan amounts12

Strategic borrowers look at total loan costs, not just interest rates. Understanding asset based mortgage loans helps make better financial choices12.

Hard Money Lending Statistics18Mortgage Loan Evaluation Research19Home Equity Market Analysis

SOFR Asset Based Loans and Options

Exploring adjustable rate asset loans means diving into SOFR mortgage rates. These rates are changing how we borrow money. The Secured Overnight Financing Rate (SOFR) is a big deal for smart borrowers20.

SOFR asset based loans have big benefits:

- Dynamic interest rate adjustments

- Flexible borrowing options for high-net-worth individuals

- Potential for lower long-term borrowing costs

Looking into SOFR mortgage rates, you’ll find many loan options. You can choose from 6-month adjustable periods to 10-year fixed-rate loans21.

“SOFR represents the future of intelligent, market-responsive lending” – Financial Innovations Quarterly

Adjustable rate asset loans let you use your assets better. Unlike old mortgage products, SOFR loans offer unprecedented flexibility in financing20.

| Loan Feature | SOFR Advantage |

|---|---|

| Interest Rate | Market-driven adjustments |

| Qualification | Asset-based evaluation |

| Borrowing Flexibility | Customized loan structures |

Your financial journey needs a mortgage that fits you. SOFR asset based loans offer a modern, adaptable way to finance property. They give you control21.

Conclusion

Starting your journey with asset based mortgage lending is a smart move towards financial freedom. These new ways of lending look at your whole asset portfolio22. They offer more than regular mortgages, thanks to their focus on your assets23.

Understanding your financial situation is key when dealing with property loans. Using your investments, retirement funds, and other assets can open doors that regular loans can’t22. Now, achieving financial freedom through lending is within reach for smart investors and buyers24.

Grasp this powerful financial tool with confidence. It’s perfect for those with a lot of money, self-employed folks, or strategic investors. Asset based mortgages can make your dream of owning property come true. Your assets are more than just numbers; they’re the keys to more real estate chances and wealth23.

Success in mortgage lending isn’t about meeting standard criteria. It’s about finding a financial solution that fits your unique situation. Your assets have a story to tell. Let them help you write the next exciting chapter of your financial journey.

Frequently Asked Questions

What is an asset based mortgage loan?

An asset based mortgage loan allows you to secure financing using your financial assets (like investments, retirement accounts, and liquid savings) as collateral, rather than relying solely on traditional income and credit scores. It evaluates your total financial health.

How does an asset based mortgage work?

Asset based mortgages work by assessing your total asset value to determine your borrowing capacity. Lenders calculate a "borrowing base" or use asset depletion formulas, taking a percentage of your qualified assets to figure out how much you can borrow, making them suitable for those with significant wealth but non-traditional income.

What types of assets are accepted for an asset based mortgage?

Lenders commonly accept various assets including retirement accounts (like 401k, IRAs), investment portfolios (stocks, bonds, brokerage accounts), and liquid assets such as checking accounts, savings accounts, Certificates of Deposit (CDs), and money market accounts. Some may also consider business equity, valuable art, or collectibles.

How is income calculated using asset depletion for a mortgage?

Asset depletion is a method used to calculate a theoretical monthly income from your assets. Lenders total your liquid assets and divide this sum by a specified period (commonly 5, 7, or 10 years) to arrive at a monthly figure that can be used for loan qualification purposes.

Who are the best candidates for asset based mortgages?

Asset based mortgages are ideal for individuals with substantial assets but who may not qualify for traditional loans due to inconsistent income or self-employment. This includes retirees with large investment portfolios, self-employed professionals, high-net-worth individuals, and real estate investors.

What are the typical requirements for an asset based loan?

Asset based lending criteria are often more flexible regarding income and credit score than traditional mortgages, though a minimum credit score (like 620) is sometimes preferred. Key requirements focus on documenting your financial health through bank statements (12-24 months), investment/retirement account statements, and verification of other liquid assets. Property evaluation is also crucial.

What are the advantages and disadvantages of asset based mortgage loans?

Advantages include flexible qualification criteria based on assets, potential for larger loan amounts, and quicker approval processes. Potential drawbacks include the risk of losing your assets if you default on the loan, possibly higher upfront costs (like origination fees), and sometimes shorter repayment terms compared to conventional mortgages.