Financial emergencies can leave you in a tight spot. When unexpected bills come up, payday loans might seem like a fast fix. But, they can harm your credit score, affecting your financial future.

Payday loans are short-term loans with high interest rates. They help cover expenses until your next paycheck. These loans usually range from $100 to $5001. The fees are high, with rates from $10 to $30 per $100 borrowed. This leads to an APR of about 400%1.

Your credit score is at risk with payday loans. Payday loans can greatly affect your credit, more so if your score is below 6001. Making the wrong choice can lead to a financial cycle hard to break.

Key Takeaways: Do Payday Loans Affect Your Credit

- Payday loans can significantly impact your credit score

- High fees and short repayment terms increase financial risk

- Borrowers with low credit scores are most vulnerable

- Timely repayment is crucial to prevent credit damage

- Alternative lending options often provide better terms

- Understanding loan mechanics can protect your financial health

- Professional financial advice can help navigate borrowing challenges

Understanding Payday Loans and Their Basic Mechanics

Exploring short-term borrowing means learning about payday loans. These loans seem like a fast fix for money needs. But, they have complex details that borrowers need to know.

We've created this table to help you compare different online loan matching services. These services can connect you with a network of lenders, offering various types of loans to fit your needs.

In this table, you'll find key details such as the loan provider's name, the range of loan amounts they can help you find, typical approval and payout speeds, and the types of loans they offer.

To get a complete picture, including details about potential costs like APRs and fees, specific credit requirements, the application process, security information, and other considerations, we encourage you to visit the related service's page directly.

Please remember that these services are not direct lenders, so your specific loan terms will be determined by the actual lender, and those details can vary. Please note that we may receive an affiliate commission if you click on links or apply through this page, however, this does not influence our recommendations.

We hope this comparison table helps you in your search!

Payday loans are a special kind of short-term loan. They help cover money gaps until your next paycheck. The loan calculator can show you the costs of these quick loans.

What Defines a Payday Loan

A payday loan is a small, high-interest loan due on your next payday. It has a few key features:

- Small loan amounts from $100 to $500

- Very short repayment periods

- High-interest rates compared to regular loans

- Little paperwork needed

How Payday Loans Function

Payday loans work in a simple way. Lenders give you cash expecting full payment by your next paycheck2. The interest rates can be as high as 400% a year, making these loans very costly2.

Typical Loan Terms and Amounts

Payday loans have certain rules:

- Loan terms last from two to four weeks2

- Loan amounts usually range from $100-$500

- There are immediate fees that affect how much you owe

“Payday loans can be a financial minefield if not approached carefully.” – Financial Expert

Warning: While payday loans offer quick cash, they can lead to debt traps. Many people find it hard to pay back on time, leading to more borrowing2.

It’s important to understand payday loans to make smart financial choices. Think about other borrowing options before getting a payday loan.

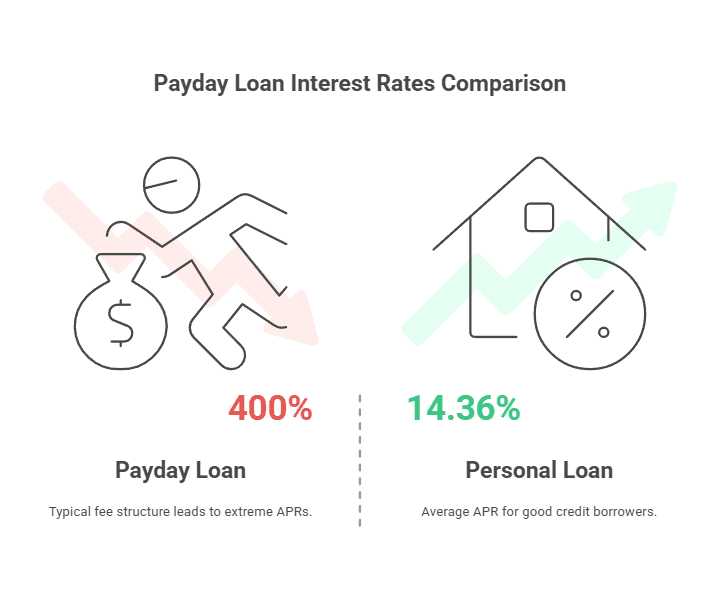

The True Cost of Payday Loans: Interest Rates and Fees

Payday loan interest rates can be very high. This creates a financial trap for people who borrow money. In 39 states, payday lenders charge more than 100% interest per year. Some loans have APRs over 1,000%3.

These high fees can turn a small loan into a huge financial problem.

“Every dollar borrowed comes with a hidden cost that can spiral out of control.” – Financial Experts

Let’s look at the real cost of payday loans:

- Typical fee structure: $10 to $30 per $100 borrowed

- Two-week loan example: $15 fee on $100 translates to roughly 400% APR

- Potential long-term financial damage from short-term borrowing

To understand payday loan interest rates better, compare them with other loans:

| Loan Type | Average APR |

|---|---|

| Personal Loan (Good Credit) | 14.36% |

| Commercial Bank Loan | 12.32% |

| Credit Union Loan | 10.80% |

| Payday Loan | 400% – 1,000% |

Warning: Most experts say to avoid loans with APRs over 36%4. Payday loans are much higher, making them very risky.

It’s important to know the real cost of payday loans to protect your money. These high interest rates can lead to a debt cycle that’s hard to get out of.

Do Payday Loans Affect Your Credit

Understanding payday loans and their effect on your credit score can be tricky. These loans might harm your credit more than you think5.

Payday loans can lead to unexpected credit problems. Approximately 12 million Americans take out payday loans each year. Many don’t realize the credit damage they might face5.

Direct Impact on Credit Reports

Most payday lenders don’t report good payment history to credit bureaus. This means timely payments won’t improve your score. But, problems can arise quickly5.

When Payday Loans Can Damage Credit

- Defaulting on a loan can decrease your credit score by up to 100 points5

- Multiple payday loans increase the risk of credit score damage5

- Late payments can trigger negative reporting

Collection Accounts and Credit Scores

If you can’t repay a payday loan, lenders might sell your debt to collection agencies. These collection accounts can stay on your report for up to seven years, causing lasting damage6.

| Payday Loan Credit Impact | Potential Consequences |

|---|---|

| On-time Repayment | No Credit Score Improvement |

| Late Payment | Potential Credit Score Drop |

| Default | Significant Credit Score Damage |

“Your credit is a financial passport – protect it carefully.” – Financial Advisor

Borrowers with many payday loans are 20% more likely to see their scores drop5. The risks of these loans are often greater than the temporary benefits they offer56.

Payday Loan Application Process and Requirements

Understanding the payday loan application process is key. It’s important to know the requirements and the financial risks involved. Payday loans might seem quick, but you must meet certain criteria to qualify7.

Here are the main requirements for payday loans:

- Valid government-issued identification

- Proof of steady income

- Active checking account

- Minimum age of 18 years

- Verifiable contact information

The application process is designed to be easy. Many lenders offer quick decisions, with funds in your account within 24 hours7. You can apply online or in-person, needing only a few documents7.

We've created this table to help you compare different online loan matching services. These services can connect you with a network of lenders, offering various types of loans to fit your needs.

In this table, you'll find key details such as the loan provider's name, the range of loan amounts they can help you find, typical approval and payout speeds, and the types of loans they offer.

To get a complete picture, including details about potential costs like APRs and fees, specific credit requirements, the application process, security information, and other considerations, we encourage you to visit the related service's page directly.

Please remember that these services are not direct lenders, so your specific loan terms will be determined by the actual lender, and those details can vary. Please note that we may receive an affiliate commission if you click on links or apply through this page, however, this does not influence our recommendations.

We hope this comparison table helps you in your search!

“Quick access doesn’t mean risk-free. Always understand the full terms before signing.” – Financial Expert

Eligibility is quite flexible. Lenders aim at those with low credit scores, even as low as 4007. Most applications don’t require a hard credit check7.

Yet, payday loans come with big risks. The average APR is 300% to 500%, making it hard to pay back7.

Before applying for a payday loan, check all the requirements. Also, think about the long-term financial effects of borrowing money for a short time.

What Happens When You Default on a Payday Loan

Defaulting on a payday loan can lead to serious financial problems. When you miss payments, lenders become aggressive collectors. This puts your financial stability at risk8.

Additional Fees and Charges

Defaulting on a payday loan comes with harsh penalties. The moment you miss a payment, you’ll face:

- Substantial late payment fees

- Rapidly accumulating interest charges

- Potential overdraft penalties

Borrowers can quickly get trapped in aspiraling debt cycle. Original loan amounts are overshadowed by mounting charges8.

Collections and Legal Consequences

Payday loan collections can be relentless. Debt collectors may:

- Repeatedly contact you via phone and mail

- Pursue legal action to recover funds

- Seek wage garnishment

Your credit score could drop by up to 100 points. This makes future financial transactions very hard8.

Impact on Future Borrowing

Defaulting on payday loans creates lasting financial barriers. About 70% of borrowers who default take more loans, leading to a debt spiral8. Your credit report will show these consequences. This can block access to:

- Traditional bank loans

- Credit cards

- Rental agreements

- Employment opportunities

“Your financial reputation is more fragile than you think – protect it vigilantly.”

Safer Alternatives to Payday Loans

Getting out of the payday loan cycle needs careful planning. There are safer ways to borrow money. These options can help you deal with sudden money needs without getting stuck in debt.

Here are some safe borrowing options to consider:

- Personal loans from online providers9

- Credit card cash advances

- Credit-builder loans9

- Secured credit cards9

- Family and friend loans

Credit-builder loans are a smart way to borrow. They usually offer between $300 to $1,000. You pay them back over 12 to 36 months9. They also help improve your credit score by reporting payments to credit bureaus9.

“Financial freedom starts with making smart borrowing decisions.”

When looking at payday loan alternatives, compare these features:

| Loan Type | Maximum Limit | Interest Rate | Credit Impact |

|---|---|---|---|

| Small Personal Loans | $1,000-$2,5009 | Up to 36% APR9 | Positive |

| Credit-Builder Loans | $300-$1,0009 | Varies | Positive |

| Secured Credit Cards | Deposit-based | Higher than unsecured9 | Positive |

Pro tip: Experian Boost can boost your credit score. It adds utility and subscription payments to your report9.

The aim is to find alternatives that offer financial flexibility and improve your credit score. Carefully review each option to choose the best for your financial situation.

How to Handle an Existing Payday Loan Responsibly

Dealing with payday loans can be tricky. If you have one, knowing your options is key to managing it well10. Your financial health depends on making smart choices and acting fast.

Creating a Repayment Strategy

Start by understanding your loan’s terms. Most payday loans need to be paid back in one go11. Here are some steps to follow:

- Figure out the total amount you owe, including fees

- Look at your budget

- Think of ways to make more money

- Make paying off the loan your top priority

Working with Lenders on Payment Plans

Talking to your lender is crucial. Some places, like Washington, offer help. You might get a 90-day repayment plan without extra fees10. Reach out to your lender to see if they can work with you.

Seeking Professional Financial Advice

If you’re feeling stuck, get help from a financial advisor. They can:

- Look at your finances

- Help you pay off debt

- Talk to lenders for you

- Check out debt consolidation options

“Your financial challenges are temporary, but smart decisions are permanent.” – Financial Wisdom

It’s not just about paying off the loan. It’s about building a better financial future for yourself.

| Repayment Strategy | Key Actions |

|---|---|

| Budgeting | Cut unnecessary expenses |

| Income Boost | Seek temporary side gigs |

| Lender Negotiation | Request extended payment plan |

By using these strategies, you can turn a tough financial spot into a chance for growth and stability12.

Conclusion

Dealing with payday loans needs smart planning and keeping your credit score safe. It’s key to know the risks to stay financially healthy13. About 35% of your credit score comes from how you pay bills, so every choice matters13.

Payday loans can lead to big debt problems. Every year, 12 million people use these loans14. Yet, 80% of them find it hard to pay back on time14. This shows the big risks to your credit score that you should think about carefully.

Smart choices are essential for your financial path. While payday loans might seem easy, looking at other options can help your credit in the long run. Keep your credit use under 30% and pay on time to build a strong financial base13.

Your financial future depends on today’s decisions. By knowing how payday loans work, getting advice, and being financially disciplined, you can handle short-term money issues. This way, you keep your credit score and overall financial health safe.

Frequently Asked Questions About Payday Loans and Credit

Do payday loans hurt your credit score?

Payday loans may not impact your credit if paid on time, as they often aren't reported. However, late payments and defaults are reported to major credit bureaus like Experian, Equifax, and TransUnion, causing your credit score to drop significantly. A collection account can remain on your report for 7 years.

Do payday lenders check your credit?

Most payday lenders don't perform a hard credit check. Some might do a soft check or check alternative credit bureaus such as Clarity Services, FactorTrust, and DataX. While a soft check doesn't initially hurt your score, a default they report will.

Can a payday loan help me build credit?

No, payday loans typically do not help build credit because lenders usually don't report on-time payments to the major credit bureaus. For building credit, alternatives like secured credit cards or credit-builder loans are recommended.

What happens if I fail to repay my payday loan?

If you cannot repay, you may face significant consequences, including late fees, overdraft fees, aggressive calls from debt collectors, potential lawsuits, wage garnishment, and a severely damaged credit score.

How long does a payday loan default stay on my credit report?

A default or a collection account related to a payday loan can remain on your credit report for up to 7 years.

Are there better alternatives to payday loans?

Yes, alternatives include personal installment loans, Payday Alternative Loans (PALs) from federal credit unions, or even a credit card cash advance (be mindful of fees). Non-profit organizations also offer financial counseling and emergency aid. Borrowing from friends/family and finding side hustles are other options.

Can I dispute a payday loan entry on my credit report?

Yes, you have the right to dispute any inaccurate information on your credit report, including payday loan details, by contacting the credit bureaus and the lender directly under the Fair Credit Reporting Act (FCRA).