Imagine driving your dream car home today. But, the auto loan application process can seem like a complex roadmap. Knowing how to apply for a car loan can make your journey easier and more empowering1. It all starts with understanding the process and preparing well.

The auto loan timeline doesn’t have to be long. Most lenders can make decisions quickly, often in a few hours or days1. Whether you want a new or used car, knowing the right steps can speed up your financing.

Your credit score is very important in this journey. Scores range from 300 to 900, and knowing yours can greatly affect your loan terms1. For qualified borrowers, rates can start as low as 5.49%1. This makes owning your dream car more achievable than you might think.

Key Takeaways: How Long Does It Take to Get a Car Loan

- Car loan applications can be completed in under an hour

- Credit scores significantly influence loan approval and rates

- Loan terms range from 36 to 84 months

- Pre-qualification can speed up the entire process

- Documentation preparation is key to quick approval

Understanding the Car Loan Application Process

Getting a car loan can seem tough. You need to plan well to get the best deal for your car2. Knowing what lenders want is key.

We've created this table to help you compare different online loan matching services. These services can connect you with a network of lenders, offering various types of loans to fit your needs.

In this table, you'll find key details such as the loan provider's name, the range of loan amounts they can help you find, typical approval and payout speeds, and the types of loans they offer.

To get a complete picture, including details about potential costs like APRs and fees, specific credit requirements, the application process, security information, and other considerations, we encourage you to visit the related service's page directly.

Please remember that these services are not direct lenders, so your specific loan terms will be determined by the actual lender, and those details can vary. Please note that we may receive an affiliate commission if you click on links or apply through this page, however, this does not influence our recommendations.

We hope this comparison table helps you in your search!

Required Documentation for Auto Loans

Having the right documents is essential for a smooth loan application. Lenders usually ask for:

- Proof of income (recent pay stubs)

- Government-issued ID

- Proof of residence

- Social Security number

- Employment verification

Basic Eligibility Requirements

Auto loans need more than just documents. Lenders look at several important things3:

| Requirement | Typical Criteria |

|---|---|

| Credit Score | 660+ for competitive rates |

| Income Stability | Minimum 2-year employment history |

| Debt-to-Income Ratio | Below 43% |

Income Verification Steps

Verifying your income for a car loan is detailed4. Lenders check your:

- Annual income

- Employment consistency

- Additional revenue streams

“Your financial preparation determines your lending success.” – Auto Finance Expert

Pro Tip: Digital applications make things easier, allowing for quicker checks and approvals2. Use online tools and calculators to help you.

How Long Does It Take to Get a Car Loan

Getting a car loan can seem like a long journey. The time it takes depends on several important factors. These factors can greatly affect your car buying experience4. Generally, the whole process can take from a few hours to a couple of weeks4.

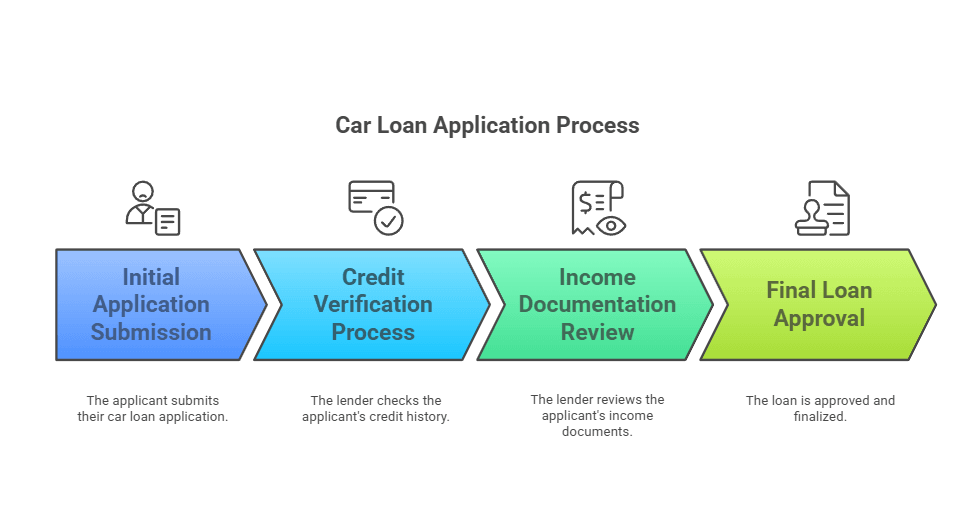

The car loan application process has a clear path. Here’s what you can expect:

- Initial application submission

- Credit verification process

- Income documentation review

- Final loan approval

Different lenders have different times for approving car loans. For example, some online platforms offer pre-approval in 485. Autopay says their approval might take up to 48 hours, with funding taking up to two weeks5.

Your financial situation greatly affects how fast you get approved. People with good credit and stable jobs usually get approved faster4.

“Speed in auto financing is about preparation and financial readiness.” – Financial Expert

Here are some loan details you might see:

| Lender | Loan Terms | Interest Rates |

|---|---|---|

| Capital One | 24-84 months | Varies |

| PenFed | 36-84 months | Starting at 4.44% |

| MyAutoloan | 24-72 months | Starting at 6.94% |

Pro Tip: Many lenders let you pre-qualify without hurting your credit score. This helps you explore options wisely5.

Factors That Impact Car Loan Approval Time

Getting a car loan involves knowing what lenders look for. Your financial situation is key to getting auto financing fast with the right preparation.

When you apply for a car loan, several important factors come into play. These factors can speed up or slow down your approval. Let’s look at the main factors lenders check.

Credit Score Impact

Your credit score is very important for getting a car loan. There’s no one minimum credit score for car loans, as lenders set their own rules6. A score above 700 usually means you can get good interest rates7. Keeping your credit score high can help you get approved faster.

- Keep your credit card balances under 30% of your available credit

- Avoid late payments

- Don’t close long-standing credit accounts

Employment History Requirements

Lenders also look at how long you’ve been working. A steady job history shows you can pay back the loan. Most lenders want to see at least two years of the same job or industry to make sure you’re financially stable.

Debt-to-Income Ratio Considerations

Your debt-to-income ratio is also important. Your car payment should not be more than 25% of your monthly income. For example, if you make $3,000 a month, your car payment should be under $7507.

| Credit Score Range | Loan Approval Likelihood | Potential Interest Rate |

|---|---|---|

| 300-579 | Low | Higher |

| 580-669 | Fair | Moderate |

| 670-739 | Good | Competitive |

| 740-850 | Excellent | Lowest |

Pro Tip: Small improvements in your credit score can lead to substantial savings over the life of your auto loan.

Understanding and improving these factors can make your loan application smoother. This can also help you get better financing terms.

Different Ways to Apply for Auto Financing

When looking for car loans, planning is key. You can choose from many auto financing options. Each has its own benefits and things to think about8.

- Traditional Bank Financing: Offers competitive rates9

- Credit Union Options: Members often get lower rates

- Online Lenders: Fast online applications

- Dealership Financing: Easy but might have higher rates8

Your credit score is very important for getting a good car loan. Lenders usually want scores of 670 or higher for the best rates8.

“Choose your financing path wisely – it can save you thousands over your loan term.”

When looking at car loan options, keep these points in mind:

| Financing Method | Average Interest Rate | Approval Speed |

|---|---|---|

| Bank Loans | 4.33% (New Cars)9 | 5-7 Business Days |

| Credit Unions | 3-5% | 3-5 Business Days |

| Online Lenders | 4-9% | 24-48 Hours |

| Dealership | 8.62% (Used Cars)9 | Same-Day |

Tip: Get pre-approved before going to dealerships. This gives you a clear budget and can help you negotiate better8.

We've created this table to help you compare different online loan matching services. These services can connect you with a network of lenders, offering various types of loans to fit your needs.

In this table, you'll find key details such as the loan provider's name, the range of loan amounts they can help you find, typical approval and payout speeds, and the types of loans they offer.

To get a complete picture, including details about potential costs like APRs and fees, specific credit requirements, the application process, security information, and other considerations, we encourage you to visit the related service's page directly.

Please remember that these services are not direct lenders, so your specific loan terms will be determined by the actual lender, and those details can vary. Please note that we may receive an affiliate commission if you click on links or apply through this page, however, this does not influence our recommendations.

We hope this comparison table helps you in your search!

Pre-approval vs. Direct Dealership Financing

Getting a car loan can seem complicated. Choosing the right financing option is key to saving money when looking at financing choices.

Getting pre-approved for a car loan can change your buying experience. Banks and credit unions often have better deals than dealerships. This can save you a lot of money over time10.

Benefits of Getting Pre-approved

- Increased negotiation power at the dealership

- Clear understanding of your budget

- Reduced pressure during car shopping10

Dealership Financing Options

Dealerships have their own benefits. They sometimes offer deals like 0% interest for certain buyers. This can save you thousands10. Pro tip: Always compare multiple financing options before committing.

| Financing Type | Interest Rates | Flexibility |

|---|---|---|

| Bank Pre-approval | Lower rates | High |

| Dealership Financing | Potentially higher | Moderate |

Online Lender Advantages

Online lenders are changing auto financing with fast approvals. Some can decide in 2-3 hours, and offers last 30 days11. This speed and ease make online lending a great choice.

“Know your options before stepping into the dealership – knowledge is financial power!”

Your car loan pre-approval journey needs careful research and planning. Knowing about dealership financing helps you make a smart choice for your money.

Steps to Speed Up Your Car Loan Application

To get your car loan approved faster, you need to prepare well and make smart financial choices. A proactive approach can help avoid delays in the auto financing process12.

Here are the key steps to get your car loan approved quickly:

- Check and clean up your credit report13

- Gather all necessary financial documentation

- Get pre-approved before visiting dealerships12

- Automate payment preparations to demonstrate reliability12

Your credit score is crucial for a smooth loan process. Scores above 740 often get the best loan terms13. Try to lower your credit use and make sure all your documents are correct and complete13.

“Preparation is the key to fast and efficient car loan approval.” – Financial Expert

Here are some financial tips to speed up your auto financing:

| Strategy | Potential Impact |

|---|---|

| Down Payment | 20% recommended to minimize loan balance12 |

| Credit Score | Above 740 for best rates13 |

| Payment Automation | Reduces late fee risks12 |

Pro tip: Getting pre-approved can boost your borrowing power and get you better loan rates for up to 70% of applicants12. By using these strategies, you’ll move through the car loan application quickly and confidently.

Common Reasons for Car Loan Delays

Dealing with delays in car loan applications can be really frustrating. Knowing what might slow things down can help you get ready and speed up the process14.

There are a few main reasons for these delays:

- Incomplete Documentation: Missing or wrong paperwork is a big reason for delays14. About 10% of loan approvals get held up because of mistakes14.

- Credit Verification Issues: Your credit score is very important for getting a loan. If there are problems or your score is low, it can slow things down a lot.

- Insurance Complications: Around 13% of drivers might have trouble with their vehicle insurance15.

“Preparation is the key to overcoming auto loan application delays.” – Financial Expert

Technical problems and bank holidays can also cause delays in getting your money14. Usually, electronic transfers take 24 to 48 hours14.

To avoid delays, you can take a few steps:

- Get all your documents ready early

- Check your credit report for errors

- Make sure your insurance is complete

- Keep in touch with your lender

By knowing what might cause delays, you can move through the car loan application process better. This can help avoid unnecessary delays1415.

Conclusion

Understanding car loans is key to making smart choices. Knowing how to navigate the process can lead to great financing deals16. Start your journey to successful auto financing by learning and preparing.

Making smart financial moves can really help you get a loan. It’s important to build a good credit score, gather all needed documents, and know how different things affect your application17. Putting down a bigger down payment can also help you get approved faster and get better interest rates17.

Online services have changed how we get car loans, with almost 60% of people now using online services16. This makes it easier to find and get car loans. With the right planning and approach, buying a car can be empowering, not scary.

Every financial choice you make affects your future with cars. By using the tips from this guide, you’re setting yourself up for a better car loan experience. The road to owning a car is ahead – go with confidence and knowledge.

Frequently Asked Questions

How long does it take to get approved for a car loan?

Pre-approval can take minutes online if you're prepared. From application to driving off, it generally takes a few hours to a few days. Dealerships might finalize in a few hours, while banks/credit unions can take a few days to a week. Factors like credit score, income, application completeness, and loan type affect speed.

Does pre-approval guarantee a car loan?

No, pre-approval is a strong indicator but not a guarantee. It means the lender is tentatively willing to offer a loan based on your creditworthiness. Final approval depends on the specific car, final loan terms, and any changes in your financial situation or the vehicle itself since pre-approval.

What documents are required for a car loan application?

You typically need proof of income (pay stubs/tax returns), proof of residence (utility bill), a valid driver's license, and Social Security number. If trading in a car, you'll need its title and registration. Details about the car you want to buy, like the VIN, are also necessary.

How does my credit score affect getting a car loan?

Your credit score significantly impacts the process. A higher score usually leads to lower interest rates and faster approval. A lower score might still allow approval, but with higher rates, stricter terms, and potentially longer approval times as lenders assess your creditworthiness.

Can I get a car loan if I have bad credit?

Yes, it's possible to get a car loan with bad credit, but it will likely mean higher interest rates and possibly a larger down payment. Some lenders specialize in bad credit loans. It may take longer to find a lender, so it's advised to shop around and consider improving your score first.

What is the difference between applying online and at a dealership?

Online lenders often provide faster pre-approval and potentially more competitive rates, allowing you to compare offers easily. Dealerships offer convenience by allowing you to finance where you buy, but they might have fewer options, potentially higher rates, and the finalization could take longer.

What can cause delays in the car loan approval process?

Delays can be caused by incomplete applications, errors in your credit report, issues verifying income or employment, high application volume at the lender, or problems with the vehicle itself like title or purchase agreement issues.