Did you know FHA loans can have down payments as low as 3.5%? This makes it easier to buy land and a home together. Understanding the process and options for land loans is key. You’ll need to check your finances and see how much you can spend on the land and any future projects.

When looking at land loans, consider the requirements. Vacant land loans often need bigger down payments and might have higher interest rates. It’s important to find a loan that fits your needs, whether it’s for land or a traditional mortgage.

Key Takeaways: Loan for Land

- Research different land loan options, including FHA loans and conventional loans, to find the best fit for your needs.

- Evaluate your finances to determine how much you can afford to spend on land and construction or development.

- Consider the requirements for vacant land loans, including larger down payments and potentially higher interest rates.

- Look into options for getting a loan for land purchase, such as seller financing or traditional mortgages.

- Understand the importance of finding the right loan for your needs, whether you’re looking for a loan for land or a more traditional mortgage.

- Be aware of the various land loan options available, including loan for land and land loan options, to make an informed decision.

- Ensure that monthly payments for land and house loans do not exceed 25% of monthly take-home income.

We've created this table to help you compare different online loan matching services. These services can connect you with a network of lenders, offering various types of loans to fit your needs.

In this table, you'll find key details such as the loan provider's name, the range of loan amounts they can help you find, typical approval and payout speeds, and the types of loans they offer.

To get a complete picture, including details about potential costs like APRs and fees, specific credit requirements, the application process, security information, and other considerations, we encourage you to visit the related service's page directly.

Please remember that these services are not direct lenders, so your specific loan terms will be determined by the actual lender, and those details can vary. Please note that we may receive an affiliate commission if you click on links or apply through this page, however, this does not influence our recommendations.

We hope this comparison table helps you in your search!

Understanding Land Loans: The Basics

When you think about buying land, knowing about land loans is key. The rates and terms can change a lot, based on the lender and why you’re buying the land. To get a land loan, you’ll need to meet certain criteria. This might include a big down payment and a good credit score.

There are many types of land loans, each with its own rules. It’s important to look around and compare rates and terms to find what works best for you. Also, knowing how to qualify for a land loan can help you through the application process and boost your chances of getting approved.

What Is a Land Loan?

A land loan lets you buy a piece of land for different uses, like building a house, farming, or investing. These loans are different from regular mortgages because they usually need a bigger down payment and have higher interest rates.

How Land Loans Differ from Traditional Mortgages

Land loans and regular mortgages are not the same. Mortgages usually have lower interest rates and ask for smaller down payments. But, land loans need a bigger down payment and have higher rates because lending on empty land is riskier.

Types of Property You Can Finance

You can finance different kinds of property with a land loan, like raw land, improved land, and construction land. Each type has its own rules and things to think about. It’s important to understand these differences to make a smart choice.

| Type of Property | Description |

|---|---|

| Raw Land | Unimproved land with no utilities or infrastructure |

| Improved Land | Land with some utilities and infrastructure, such as roads and electricity |

| Construction Land | Land intended for construction, with necessary permits and approvals |

The Current State of Land Loan Markets

Looking for a land loan? You should choose the best land loan providers for a good deal. The land loan market is competitive, with many lenders offering different loans. It’s key to compare lenders for the best interest rates, terms, and conditions.

Consider using a mortgage broker who knows land loans. They can help you find the best land loan lenders. Also, a reputable land broker can guide you and help you make a smart choice. If you’re unsure how to get a loan for land, start by comparing different lenders.

When researching land loan lenders, keep these points in mind:

- Interest rates and terms

- Loan-to-value ratio

- Credit score requirements

- Down payment expectations

By researching and working with the right professionals, you can find the best land loan. The best land loan providers offer competitive rates and great service. Always ask questions and seek advice to make the best choice for you.

Always keep your financial goals in mind. Seek out the best land loan lenders to help you reach them. With the right loan and guidance, you can turn your land purchase dreams into reality.

Different Types of Land Loans Available

When you’re buying land, knowing about the different land loans is key. The requirements and interest rates for these loans vary a lot. For example, raw land loans are riskier, so they have higher rates and often need a big down payment, like 20-30%.

Improved land loans, though, usually ask for about a 20% down payment. This is because improved land is seen as safer by lenders than raw land.

Construction-to-permanent loans need detailed plans and a clear budget. They combine land purchase and building financing. It’s important to look into land loans and their benefits and requirements. This way, you can pick the best loan for you.

When looking at land loan options, consider a few things:

- Interest rates and repayment terms

- Down payment and credit score needs

- Loan amount and debt-to-income ratio

By looking at these factors and exploring different financing options, you can find the right loan. Whether it’s for raw, improved, or construction land, knowing your options is the first step to making your dream a reality.

Key Factors That Affect Your Land Loan Eligibility

When you apply for a land purchase loan, many things matter. Your credit score, income, debt, and land value are all important. A good credit score, stable income, and low debt help a lot. It’s also smart to look around for the best loan, knowing where to find land loans and how to get a land loan.

Some key factors that impact your eligibility include:

- Credit score: A good credit score can help you qualify for better interest rates and terms.

- Income: A stable income will help you demonstrate your ability to repay the loan.

- Debt-to-income ratio: A low debt-to-income ratio will show that you have a manageable amount of debt and can afford the loan payments.

- Land value: The value of the land will impact the amount of the loan and the interest rate you qualify for.

Knowing these factors and working to improve your chances can help. By looking at different lenders, you can find the best one for you. This increases your chances of getting the loan you need.

| Factor | Impact on Eligibility |

|---|---|

| Credit Score | A good credit score can help you qualify for better interest rates and terms. |

| Income | A stable income will help you demonstrate your ability to repay the loan. |

| Debt-to-Income Ratio | A low debt-to-income ratio will show that you have a manageable amount of debt and can afford the loan payments. |

| Land Value | The value of the land will impact the amount of the loan and the interest rate you qualify for. |

Essential Requirements for Getting a Loan for Land

To get a loan for land, you need to meet certain criteria. You must have a good credit score, make a significant down payment, and provide detailed income and asset information. When you find land loan lenders with the best rates for land loans, they check your credit, income, and the land’s value and use.

Credit Score Requirements

A good credit score is key for the land loan approval process. Lenders look at your credit score to see if you’re trustworthy and to set your interest rate. A higher score usually means better rates and terms.

We've created this table to help you compare different online loan matching services. These services can connect you with a network of lenders, offering various types of loans to fit your needs.

In this table, you'll find key details such as the loan provider's name, the range of loan amounts they can help you find, typical approval and payout speeds, and the types of loans they offer.

To get a complete picture, including details about potential costs like APRs and fees, specific credit requirements, the application process, security information, and other considerations, we encourage you to visit the related service's page directly.

Please remember that these services are not direct lenders, so your specific loan terms will be determined by the actual lender, and those details can vary. Please note that we may receive an affiliate commission if you click on links or apply through this page, however, this does not influence our recommendations.

We hope this comparison table helps you in your search!

Down Payment Expectations

Land loans usually ask for a big down payment, from 20% to 50% of the land’s price. A bigger down payment can get you a lower interest rate and avoid extra insurance costs.

Income and Asset Documentation

To show you can pay back the loan, you’ll need to provide income and asset details. This includes proof of income, tax returns, and bank statements. Knowing these needs helps you find the right land loan lenders and get through the land loan approval process smoothly.

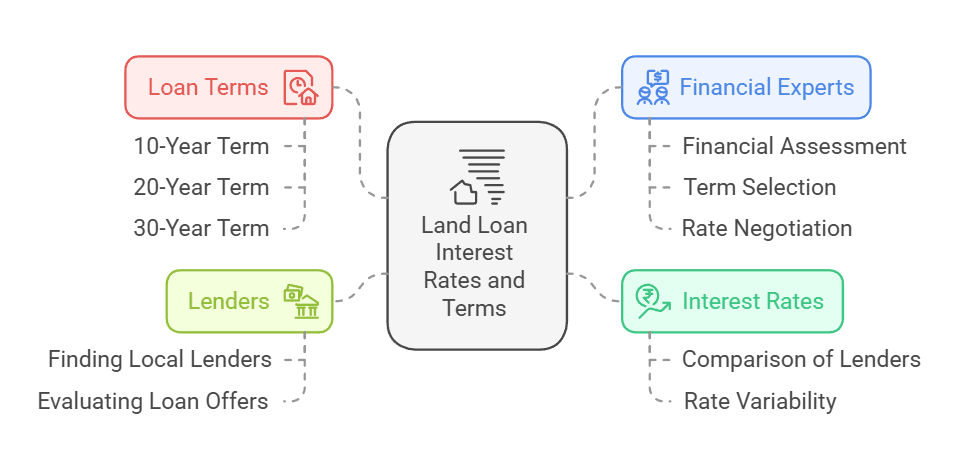

Understanding Land Loan Interest Rates and Terms

When you’re looking to qualify for a land loan, knowing about interest rates and terms is key. The rates can change, so it’s smart to compare different lenders. This way, you can find the best deal for your situation.

For financing your land purchase, think about the loan term lengths. Loans can last from 10 to 30 years. Each option has its own benefits and drawbacks.

A 10-year loan has lower rates and less interest over time but higher monthly payments. A 20-year loan balances affordable payments with lower rates. On the other hand, a 30-year loan means lower monthly payments but more interest and higher rates.

To find the right land loans near me, talk to a financial expert. They can guide you through the process. They’ll help you figure out your financial situation, choose the right term, and find a lender with good rates and terms.

Understanding land loan interest rates and terms is vital for making a smart choice. By doing your research, comparing lenders, and considering term options, you can secure the best financing for land purchase. This will help you reach your goals.

How to Find the Right Land Loan Lender

When applying for a land loan, finding a lender with the best land loan rates is key. With many vacant land loan lenders out there, picking the right one can be tough. Start by looking for a mortgage broker who knows about land loans or by comparing lenders online.

A good credit score, usually 680 or higher, is needed for the best rates. Lenders want to see a clear plan for using the land. They also check your debt-to-income ratio to make sure you can handle the loan.

When looking at vacant land loan lenders, consider a few things:

- Interest rates and terms

- Reputation and customer service

- Down payment needs, which can be 20% to 50% based on the land type

By looking at these factors and what you need, you can find the best lender. This way, you’ll get the best land loan rates for your purchase.

| Land Loan Type | Down Payment | Interest Rate |

|---|---|---|

| Raw Land Loan | 30-50% | 7-10% |

| Improved Land Loan | 10-20% | 5-7% |

The Land Loan Application Process Step by Step

Understanding the land loan application process is key. Land financing often requires a 20-50% down payment. This depends on the property’s development level. To start, you need to prequalify for a buying land loan. This means sharing income details and tax returns from the past 2-3 years.

A land loan calculator can show how much you can borrow. The application also includes an appraisal or survey. This gives info on the land’s value, size, and any use restrictions. It’s important to choose a lender who knows land financing well.

To make the application smooth, avoid common mistakes. These include missing documents or wrong credit reports. Knowing the steps and picking the right lender helps you confidently apply for a land loan.

Special Considerations for Vacant Land Loans

Thinking about a vacant land loan means looking at its unique aspects. It’s a chance for investment but needs careful planning. You must consider zoning, environmental assessments, and future plans.

When looking at land loan options, a vacant land loan or an agricultural land loan might be right. It’s important to know the specific rules and regulations for these loans. For example, zoning laws can change a lot based on where the land is and what you plan to do with it.

Zoning Requirements

Zoning laws can affect the land’s value and use. It’s key to research and understand these laws. This helps avoid any issues or restrictions that might block your plans.

Environmental Assessments

Environmental assessments are also crucial for vacant land loans. They can reveal hazards like wetlands or endangered species. These can impact the land’s value and use.

By carefully looking at these factors and considering your options, you can make a smart choice. Remember to explore different land loan options and their needs. This way, you can find the best fit for your goals.

Comparing Traditional Banks vs. Specialized Land Lenders

When looking for land loan lenders, you have two main choices: traditional banks and specialized land lenders. Traditional banks might have better land loan rates. But, they often have stricter rules and less flexible terms. Specialized land lenders, on the other hand, might offer more flexible terms. Yet, they might charge higher land loan rates.

According to Ramsey Solutions, specialized land lenders can be more flexible than traditional banks. This is great for those needing land financing that fits their unique needs. But, it’s crucial to research and compare different lenders to find the best fit for you.

When comparing traditional banks and specialized land lenders, consider these factors:

- Land loan rates and terms

- Flexibility of repayment schedules

- Approval times and requirements

- Reputation and customer service

By carefully looking at these factors and thinking about your specific needs, you can make a smart choice. This way, you can pick the best land loan lender for your situation.

Finding the right land loan lender means doing your homework, comparing options, and picking one that meets your needs best.

| Lender Type | Land Loan Rates | Flexibility | Approval Time |

|---|---|---|---|

| Traditional Banks | Competitive | Less flexible | Longer |

| Specialized Land Lenders | Higher | More flexible | Faster |

Important Land Surveys and Inspections

When you’re thinking about getting a land purchase loan, it’s key to know about land surveys and inspections. These steps make sure the land fits the purpose you have in mind. They check if the land is ready for building, development, or other uses.

Land loan interest rates can change based on the lender and the loan’s details. But, doing detailed surveys and inspections can help you get better rates. For example, a soil test can show if the soil is good for building, which affects the loan’s terms and rates.

When looking at land loan options, consider these important points:

- Boundary surveys to find out the property lines

- Soil testing to check the soil quality

- Access and utility checks to see if utilities and access are available

Understanding these points and doing thorough surveys and inspections helps you make a smart choice for your land loan. Always check the loan’s requirements and terms well to get the best deal.

| Land Survey Type | Purpose |

|---|---|

| Boundary Survey | To determine property lines and ensure the land is free from encumbrances |

| Soil Testing | To assess soil quality and determine its suitability for construction or development |

| Access and Utility Evaluation | To determine the availability of utilities and access to the land |

Alternative Financing Options for Land Purchase

Exploring different financing options is key when buying land. A land loan calculator can help you find the best choice. Options like seller financing, private money loans, and partnerships offer flexibility but might have higher costs.

For example, a contract for deed lets buyers pay the seller over time. This is great for those who can’t afford a big down payment. It makes the purchase more manageable.

It’s important to compare these options carefully. Use a land loan calculator to see the costs and benefits. Also, consider these factors:

- Interest rates and fees

- Repayment terms and conditions

- Flexibility and adaptability

- Credit score and income requirements

By looking into alternative financing and using a calculator, you can make a smart choice. Always review the terms and conditions of each option. Getting professional advice can also help you find the right solution for your needs.

| Financing Option | Interest Rate | Repayment Terms |

|---|---|---|

| Seller Financing | 5-10% | 5-10 years |

| Private Money Loans | 8-12% | 2-5 years |

| Partnership Agreements | varies | varies |

Common Pitfalls to Avoid When Securing a Land Loan

When you’re in the land loan approval process, knowing common pitfalls is key. Not considering all costs in financing for land purchase is a big mistake. Hidden fees can quickly add up, so it’s vital to understand your loan’s terms.

Some important things to watch out for include:

- Hidden costs and fees, such as origination fees, appraisal fees, and closing costs

- Contract terms, including the interest rate, repayment terms, and prepayment penalties

- Legal considerations, such as property rights, zoning regulations, and environmental concerns

As Ramsey Solutions points out, avoiding these pitfalls is crucial for a smooth land loan approval process. Knowing these issues helps you navigate qualifying for a land loan better. This way, you can get the financing for land purchase you need.

| Pitfall | Description |

|---|---|

| Hidden costs and fees | Additional charges that can add up quickly |

| Contract terms | Important details, such as interest rate and repayment terms |

| Legal considerations | Property rights, zoning regulations, and environmental concerns |

Tips for Improving Your Land Loan Approval Odds

To boost your chances of getting a land loan, focus on a good credit score, stable income, and low debt. Start by looking into land loans near me to find the right one for you. Look for best land loan rates and work with vacant land loan lenders who know this type of financing well.

Here are some tips to help you improve your land loan approval odds:

- Check your credit score and work on improving it if necessary. Lenders typically prefer a credit score of 700 or above for land loan applications.

- Reduce your debt-to-income ratio by paying off outstanding debts and avoiding new credit inquiries.

- Research and compare different land loan options to find the best rates and terms for your needs.

Also, consider these factors that can affect your land loan approval:

- Loan-to-Value (LTV) ratio: Most lenders offer an LTV ratio between 60% and 75% of the property’s market value.

- Employment history: Lenders often require a minimum of 2-3 years of continuous employment for eligibility.

- Property condition: The property intended for collateral must be free of legal disputes or encumbrances.

By following these tips and considering these factors, you can improve your chances of getting approved for a land loan. This will help you reach your goals of buying or developing a property. Always work with reputable vacant land loan lenders. Make sure to understand all the loan terms and conditions.

Conclusion: Making Your Land Purchase Dreams a Reality

Purchasing land can seem complex, but the right loan options can help. It’s key to research and compare different loans to find the best one for you. This ensures it fits your needs and financial situation.

Knowing the requirements for vacant land loans helps you move forward confidently. Work with trusted lenders, real estate agents, and other experts. This way, you can avoid problems and secure your dream land.

With good planning, financial readiness, and exploring all options, you can own land that fits your goals and lifestyle. So, start looking into land loan options today. Make your dream of owning land a reality.

Frequently Asked Questions

What is the typical down payment for a land loan?

Down payments for land loans are generally higher than for buying a house, often ranging from 20% to 50% of the land's purchase price. This is because raw land is seen as riskier for lenders.

Can you get a land loan with bad credit?

It's challenging but possible. A bad credit score signals risk to lenders, which will likely result in higher interest rates and potentially a larger down payment. Exploring options like seller financing or working to improve your credit score before applying are good strategies.

What is the difference between a land loan and a construction loan?

A land loan is specifically for purchasing the raw land itself. A construction loan is for financing the building of a structure on that land. Some lenders offer construction-to-permanent loans that cover both phases and convert to a standard mortgage.

How do I find the best interest rates for a land loan?

To find competitive rates, you should shop around widely. Look beyond traditional banks to credit unions, online lenders, and lenders who specialize in land loans. Compare interest rates, fees, and terms. Also, check eligibility for government-backed options like USDA or VA loans.

Are land loans available for recreational properties?

Yes, you can use a land loan for recreational property, but it can be more difficult to secure. Lenders may be more cautious about these types of properties since they aren't considered essential housing. You'll likely need a clear plan for the land's use and a strong financial profile.

How long does it take to get approved for a land loan?

The approval process for a land loan can take longer than for a traditional mortgage, often several weeks or even months. The closing process, which includes due diligence like surveys and appraisals, can take up to 90 days.

Can you get a land loan for investment purposes?

Yes, but the terms are typically tighter for investment properties compared to primary residences. Expect requirements like higher down payments and interest rates, and lenders will thoroughly review your investment plan.