Are you feeling the weight of high monthly payments? You’re not alone. Many homeowners are discovering the power of refinancing to lower their interest rates and save thousands of dollars. With the national average 30-year fixed refinance APR at 6.96% as of February 19, 2025, now is the time to take action1.

Refinancing isn’t just about lowering your rate—it’s about gaining control over your finances. By reducing your interest by just 0.5% to 0.75%, you could unlock significant savings over the life of your mortgage1. But the benefits don’t stop there. You could also shorten your loan term, access equity, or even lower your monthly payment to free up cash for other priorities.

This guide will walk you through the refinancing process, from understanding eligibility to comparing lenders. With expert tips and step-by-step advice, you’ll be equipped to make smarter financial decisions today—and enjoy greater freedom tomorrow. Don’t wait—your future self will thank you.

We've created this table to help you compare different online loan matching services. These services can connect you with a network of lenders, offering various types of loans to fit your needs.

In this table, you'll find key details such as the loan provider's name, the range of loan amounts they can help you find, typical approval and payout speeds, and the types of loans they offer.

To get a complete picture, including details about potential costs like APRs and fees, specific credit requirements, the application process, security information, and other considerations, we encourage you to visit the related service's page directly.

Please remember that these services are not direct lenders, so your specific loan terms will be determined by the actual lender, and those details can vary. Please note that we may receive an affiliate commission if you click on links or apply through this page, however, this does not influence our recommendations.

We hope this comparison table helps you in your search!

Key Takeaways: Refinance Your Home Loan

- Refinancing can save you thousands if rates are 1-2% lower than your current rate2.

- A credit score of 700+ often secures the best refinancing rates2.

- The process typically takes 30-45 days, depending on your lender2.

- Closing costs range from 2-5% of the loan amount2.

- Reducing your rate by 0.5% to 0.75% can make refinancing worthwhile1.

- Learn more about the bank loan process to prepare effectively.

Introduction to Mortgage Refinancing

Mortgage refinancing can be a game-changer for your financial strategy. It’s the process of replacing your existing mortgage with a new one, often to secure better terms. This move can help you save money, reduce monthly payments, or even access cash from your property’s equity.

What Is Mortgage Refinancing?

Refinancing involves paying off your current mortgage and replacing it with a new loan. The new loan typically comes with updated terms, such as a lower interest rate or a different loan term. This process can be beneficial if market conditions have improved since you first secured your mortgage.

For example, if you originally borrowed at a 5.5% interest rate, refinancing to a 4.0% rate could save you $188 per month on a $250,000 loan3. Over time, these savings can add up significantly.

Reasons to Consider Refinancing

There are several compelling reasons to explore refinancing. Here are the top benefits:

- Lower Interest Rates: Securing a lower rate can reduce your monthly payments and total interest paid over the life of the loan3.

- Access to Equity: Refinancing allows you to tap into your property’s equity, providing funds for home improvements, debt consolidation, or other financial goals4.

- Adjust Loan Terms: You can shorten or extend your loan term to align with your financial objectives. A shorter term means paying off your loan faster, while a longer term can lower monthly payments.

Recent data shows that the average 30-year mortgage rate is 6.87% as of February 20253. If your current rate is higher, refinancing could be a smart move.

| Loan Type | Interest Rate | Monthly Payment | Total Interest Saved |

|---|---|---|---|

| 20-Year Mortgage | 4.0% | $1,515 | $45,132 |

| 30-Year Mortgage | 4.3% | $1,237 | $82,000 |

By refinancing, you could unlock significant savings and gain greater control over your finances. Now is the time to act—your future self will thank you.

Understanding the Refinance Home Loan Process

Ready to take control of your finances? Let’s break down the process step by step. Refinancing your mortgage can seem complex, but with a clear plan, it’s straightforward. Here’s how to navigate it like a pro.

Step-by-Step Procedures

Start by checking your credit score. A score of 700 or higher often secures the best rates5. Next, gather quotes from at least three lenders to compare offers. This ensures you get competitive terms6.

Once you’ve chosen a lender, submit your application. Be prepared to provide detailed financial information. The lender will review your credit, income, and property value. This step typically takes 30-45 days5.

After approval, you’ll move to closing. Here, you’ll sign the new loan agreement and pay any closing costs, which range from 2% to 5% of the loan amount6. Once complete, you’ll start enjoying your new terms.

Key Documentation Needed

Having the right documents ready speeds up the process. Here’s what you’ll need:

| Document | Purpose |

|---|---|

| Tax Returns | Verify income and financial stability |

| Pay Stubs | Show current earnings |

| Asset Details | Demonstrate financial reserves |

| Property Appraisal | Confirm home value |

Organize these documents in advance to avoid delays. A systematic approach simplifies what may seem like a complex process.

Take action now—your future self will thank you. With these steps, you’re well on your way to unlocking significant savings and greater financial flexibility.

Benefits of a Refinance Home Loan

Imagine slashing your monthly bills while gaining financial flexibility. Refinancing your mortgage can unlock significant savings and provide opportunities to improve your financial health. Whether you’re looking to lower your payments or access equity, the benefits are clear and impactful.

Lower Interest Rates and Monthly Payments

One of the most compelling reasons to refinance is to secure a lower interest rate. Even a small reduction can lead to substantial savings. For example, refinancing a $400,000 loan from a 30-year to a 15-year term can save approximately $310,000 in interest payments over the life of the loan7.

Lower rates also mean reduced monthly payments. This frees up cash for other priorities, such as saving for retirement or paying off high-interest debt. It’s a simple step that can have a lasting impact on your financial well-being.

Unlocking Home Equity for Savings

Refinancing allows you to tap into your property’s equity. This can be a game-changer for funding renovations, consolidating debt, or even investing in other opportunities. By accessing this hidden value, you can improve your financial flexibility and achieve your goals faster.

For instance, cash-out refinancing lets you borrow more than your current mortgage balance. This option can help pay off debts, potentially improving your cash flow and positively impacting your credit score8.

- Save on interest: Lower rates reduce the total amount paid over the life of the loan.

- Reduce monthly payments: Free up cash for other financial priorities.

- Access equity: Use your property’s value to fund renovations or consolidate debt.

- Customize your term: Adjust your loan term to better fit your financial goals.

Ready to explore your options? Start by comparing lenders and understanding the potential savings. If you’re considering other financing needs, explore land financing options to make the most of your investments.

Evaluating Your Current Interest Rate and Credit Score

We've created this table to help you compare different online loan matching services. These services can connect you with a network of lenders, offering various types of loans to fit your needs.

In this table, you'll find key details such as the loan provider's name, the range of loan amounts they can help you find, typical approval and payout speeds, and the types of loans they offer.

To get a complete picture, including details about potential costs like APRs and fees, specific credit requirements, the application process, security information, and other considerations, we encourage you to visit the related service's page directly.

Please remember that these services are not direct lenders, so your specific loan terms will be determined by the actual lender, and those details can vary. Please note that we may receive an affiliate commission if you click on links or apply through this page, however, this does not influence our recommendations.

We hope this comparison table helps you in your search!

Understanding your current financial standing is the first step toward smarter money management. To determine if refinancing is right for you, start by evaluating your interest rate and credit score. These two factors play a critical role in securing better terms and saving money.

Begin by comparing your current rate with available refinance offers. If market rates are significantly lower, you could save hundreds each month. For example, reducing your rate by just 0.5% can lower your monthly payment by $188 on a $250,000 mortgage9.

Next, assess your credit score. A score of 740 or higher often secures the best rates9. If your score is lower, consider improving it before applying. Simple steps like paying down debt or correcting errors on your credit report can make a big difference.

Here’s how to evaluate your financial details effectively:

- Check your credit report: Obtain a free report from AnnualCreditReport.com and review it for accuracy.

- Compare rates: Gather quotes from multiple lenders to find the best deal.

- Analyze your loan terms: Identify if your current term is costing you extra money.

By taking these steps, you’ll gain clarity on whether refinancing is a smart move. Don’t let high costs or unfavorable terms hold you back—take charge of your financial future today.

Exploring Different Mortgage Refinance Options

When it comes to managing your finances, exploring different mortgage refinance options can open doors to significant savings. Whether you’re looking to lower your monthly payments or tap into your property’s equity, understanding the two primary options—rate-and-term and cash-out refinancing—is crucial. Each has unique benefits and risks, so choosing the right one depends on your financial goals.

Rate-and-Term Refinancing: Lowering Your Monthly Payments

Rate-and-term refinancing focuses on securing a better interest rate or adjusting your loan’s term. This option is ideal if your primary goal is to reduce monthly payments or pay off your mortgage faster. For example, switching from a 30-year to a 15-year term can save you thousands in interest over time10.

This type of refinancing is particularly beneficial when market rates are lower than your current rate. Even a small reduction can lead to significant savings. For instance, lowering your rate by 0.5% can reduce your monthly payment by $188 on a $250,000 mortgage10.

Cash-Out Refinancing: Accessing Your Home Equity

Cash-out refinancing allows you to borrow more than your current mortgage balance, giving you access to your property’s equity. This option is perfect for funding major expenses like home renovations, debt consolidation, or even investing. By leveraging your home equity, you can turn your property’s value into usable cash11.

However, this option comes with risks. Increasing your loan amount means higher monthly payments and potentially more interest over time. It’s essential to evaluate whether the benefits outweigh the costs.

Choosing the Right Option for You

Deciding between rate-and-term and cash-out refinancing depends on your financial situation. Here’s a quick guide:

- Choose rate-and-term if your goal is to lower payments or shorten your loan term.

- Opt for cash-out if you need funds for major expenses or debt consolidation.

Remember, refinancing typically costs between 2% to 5% of the loan balance11. Carefully weigh the pros and cons to make an informed decision. Your financial future depends on it.

Tips for Securing the Best Refinance Home Loan Deal

Securing the best deal on your mortgage refinance starts with smart comparison strategies. Not all lenders offer the same terms, and even small differences in interest rates or closing costs can lead to significant savings over time. Here’s how to ensure you’re getting the most favorable terms.

Comparing Offers from Multiple Lenders

Start by gathering quotes from at least three different lenders. This allows you to compare rates, fees, and loan terms side by side. A study shows that 25% of homeowners fail to shop around, potentially missing out on better deals12. Don’t let this be you—take the time to explore your options.

When evaluating offers, look beyond the interest rate. Consider factors like closing costs, prepayment penalties, and the lender’s reputation. A lower rate might not always be the best deal if it comes with high fees or poor customer service.

Here’s a quick checklist to help you compare offers effectively:

- Check the APR: The Annual Percentage Rate (APR) includes both the interest rate and fees, giving you a clearer picture of the total cost.

- Evaluate lender reliability: Read reviews and ask for recommendations to ensure you’re working with a trustworthy lender.

- Use online tools: Calculators and comparison platforms can simplify the process and highlight the best deals.

Negotiating terms can also lead to significant savings. Many lenders are willing to lower fees or offer better rates to secure your business. Don’t hesitate to ask—every dollar saved adds up over the life of your loan.

Finally, understanding your Loan-to-Value ratio can help you negotiate better terms. A lower ratio often leads to more favorable rates and reduced costs, so it’s worth exploring ways to improve it.

By taking these steps, you’ll be well on your way to securing a refinance deal that saves you money and aligns with your financial goals. Start comparing today—your future self will thank you.

Preparing for the Refinancing Process

Taking the first step toward refinancing starts with organization and preparation. Gathering the right documents is essential to ensure a smooth and efficient process. Lenders require detailed financial information to assess your eligibility and determine the best terms for your new mortgage.

Essential Documents for Refinancing

To apply for a new loan, you’ll need to provide specific documents. These help lenders evaluate your financial stability and creditworthiness. Here’s a breakdown of what you’ll need:

| Document | Purpose |

|---|---|

| Tax Returns | Verify income and financial stability |

| Pay Stubs | Show current earnings |

| Bank Statements | Demonstrate financial reserves |

| Property Appraisal | Confirm home value |

| Credit Report | Assess credit score and history |

Having these documents ready speeds up the application process. It also helps you lock in favorable rates before they change. For example, a credit score of 620 or higher is often required for conventional loans13.

Tips for Organizing Your Documents

Staying organized can save you time and reduce stress. Here are some practical tips:

- Create a folder: Keep all documents in one place, either physically or digitally.

- Label files clearly: Use descriptive names to make it easy to find what you need.

- Check for accuracy: Ensure all information is up-to-date and error-free.

Proper organization minimizes delays and helps you avoid unexpected fees. It also shows lenders that you’re serious about the process, which can work in your favor.

Time Management Strategies

Refinancing can take anywhere from 30 to 45 days, depending on the lender13. To stay on track, follow these steps:

- Set deadlines: Mark key dates on your calendar, such as document submission and closing.

- Communicate regularly: Stay in touch with your lender to address any issues promptly.

- Prepare in advance: Gather documents early to avoid last-minute rushes.

By managing your time effectively, you can ensure a smooth application process. This also increases your chances of securing the best terms available.

Ready to take the next step? Start by comparing loan offers to find the best deal for your needs. Preparation is key to unlocking significant savings and achieving your financial goals.

Managing Closing Costs and Fees

Navigating the world of refinancing can feel overwhelming, but understanding the costs involved is the first step to making informed decisions. Closing costs are fees charged by lenders and third parties during the refinancing process. These typically range from 2% to 5% of the loan amount14. Knowing what to expect can help you budget effectively and avoid surprises.

Breaking Down the Terminology

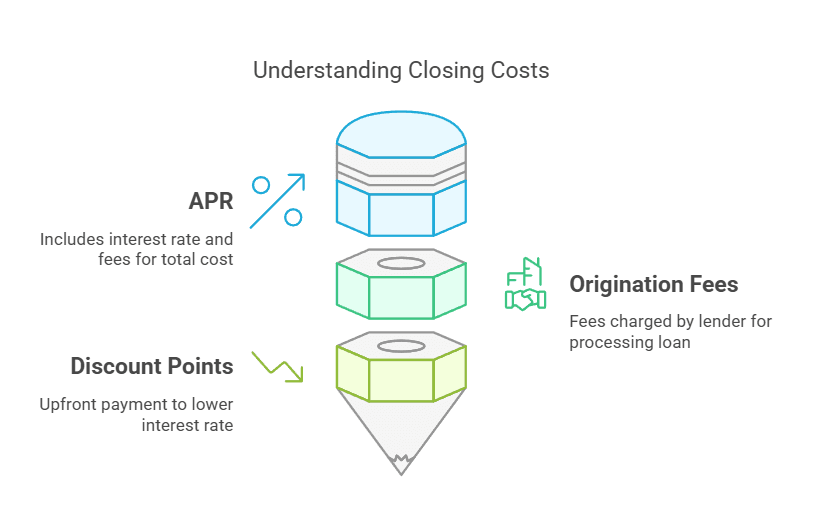

Understanding the terms associated with closing costs is crucial. Here’s a quick breakdown:

- APR (Annual Percentage Rate): This includes the interest rate plus other fees, giving you a clearer picture of the total cost15.

- Origination Fees: These are charged by the lender for processing the loan and typically range from 0.5% to 1% of the loan amount14.

- Discount Points: You can pay these upfront to lower your interest rate, which can save you money over the life of the loan.

Comparing Fees Among Lenders

Not all lenders charge the same fees, so it’s essential to shop around. Request a Loan Estimate from multiple lenders to compare costs. Look beyond the interest rate—focus on the total closing costs and any hidden fees. This step can save you thousands over time.

Strategies to Reduce or Negotiate Costs

There are several ways to minimize closing costs:

- Negotiate with the Lender: Many fees are negotiable, so don’t hesitate to ask for reductions.

- Shop for Third-Party Services: You can often choose your own title company or appraiser to find better rates.

- Consider No-Closing-Cost Options: Some lenders offer this, but be aware it may result in a higher interest rate.

For example, reducing your closing costs by $2,000 on a $200,000 loan can save you $40 per month over a 30-year term15. These savings add up, making it worth the effort to negotiate.

Reviewing Loan Documents

Before finalizing the deal, carefully review all loan documents. Ensure the terms match what you agreed to and that there are no unexpected fees. This step is your last chance to catch errors or discrepancies.

By understanding and managing closing costs, you can make refinancing a financially savvy move. For more details on how to navigate these fees, check out this guide on closing costs.

Timing Your Refinance: Market Trends and Insights

Timing is everything when it comes to making smart financial moves—especially with your mortgage. Knowing when to act can mean the difference between significant savings and missed opportunities. With 30-year fixed refinance rates hovering around 6.92%-7.06%, understanding market trends is crucial16.

Current Rates and Economic Considerations

Current economic indicators play a key role in deciding when to refinance. For instance, inflation rates reported at 3% can influence mortgage rates, making it essential to monitor these trends16. If your current interest rate is higher than the national average, now might be the time to act.

Refinance applications have surged by 10% compared to the previous week, signaling increased borrower interest17. This trend suggests that many are taking advantage of favorable conditions. By benchmarking your current rate against market averages, you can identify potential savings opportunities.

Here’s how to stay ahead:

- Monitor Rate Fluctuations: Use online tools to track changes in interest rates and economic indicators.

- Act Promptly: When favorable rates emerge, don’t wait—locking in a lower rate can save you thousands over time.

- Evaluate Your Credit Score: A score of 740 or higher often secures the best terms17.

Economic stability and market trends can signal the right time to refinance. For example, the Federal Reserve’s unchanged benchmark rate in early 2025 indicates a period of relative stability16. This could be an ideal window to secure a better rate.

Waiting too long can have risks. If rates rise, you might miss out on significant savings. By staying informed and proactive, you can make strategic decisions that align with your financial goals. For deeper insights into refinancing trends, explore this research.

Take control of your financial future by leveraging market insights and acting at the right time. Your savings depend on it.

Future Trends in Mortgage Refinancing

The future of mortgage refinancing is evolving rapidly, offering new opportunities for savvy borrowers. With interest rates predicted to drop to 6.50% by the end of 2025, staying informed can help you make smarter financial decisions18. Let’s explore what’s ahead and how you can prepare.

Experts forecast that rates could stabilize in the mid-6% range, with some predictions suggesting they may even dip into the 5% range in the coming years18. This downward trend presents a golden opportunity to secure better terms and reduce your monthly payment.

Technological advancements are also reshaping the refinancing landscape. Digital tools and AI-driven platforms are making it easier to compare lenders and streamline the application process. These innovations save time and help you find the best option for your needs.

Economic policies, such as Federal Reserve rate adjustments, will continue to influence mortgage trends. Staying ahead of these changes ensures you can act quickly when favorable conditions arise. For example, a drop in the consumer price index to 3% signals a more stable economic environment18.

Here’s how you can prepare for these trends:

- Monitor rate fluctuations: Use online tools to track changes and identify the best time to act.

- Leverage technology: Explore digital platforms to simplify the refinancing process.

- Stay informed: Keep up with economic news and policy changes that could impact loan terms.

By understanding these trends, you can position yourself to take advantage of future opportunities. The key is to stay proactive and informed. Your financial future depends on it.

Your financial future deserves a strategic approach—refinancing could be the key. By lowering your interest rate, you can unlock significant savings and reduce your monthly payment. This move not only improves your cash flow but also strengthens your financial stability.

Timing is crucial. With rates fluctuating, acting at the right moment can maximize your benefits. A credit score of 620 or higher often secures the best terms, so take steps to improve your credit if needed19.

Refinancing also allows you to tap into your equity, providing funds for renovations or debt consolidation. This can increase your property’s value and ease financial stress20.

Take control of your finances today. Compare offers from multiple lenders and make an informed decision. Your future self will thank you for the savings and peace of mind.

Frequently Asked Questions

What is mortgage refinancing?

Mortgage refinancing is the process of replacing your current home loan with a new one. This is often done to secure a lower interest rate, reduce monthly payments, change the loan term, or access equity in your property.

What are the main benefits of refinancing a home loan?

Key benefits include lowering your interest rate to save money over the life of the loan, reducing your monthly mortgage payments, adjusting your loan term to pay it off faster or lower payments, and accessing your home's equity for other financial needs like renovations or debt consolidation.

How does the home loan refinancing process work?

The process involves checking your credit score (a score of 700+ is often best), gathering quotes from multiple lenders, submitting a detailed financial application, the lender reviewing your information and ordering an appraisal, getting approved, and finally, closing the new loan agreement and paying closing costs.

What documents are typically required when applying for a mortgage refinance?

Lenders typically require documents such as tax returns, pay stubs, bank statements, asset details, and information about your current mortgage. You will also need a property appraisal to confirm your home's value and consent for a credit report.

What is the difference between rate-and-term and cash-out refinancing?

Rate-and-term refinancing focuses on changing your interest rate or the length of your loan term, primarily to lower monthly payments or pay off the loan faster. Cash-out refinancing allows you to borrow more than your outstanding balance, converting home equity into cash for other uses.

How can I get the best deal when refinancing my mortgage?

To secure the best deal, you should compare offers from at least three different lenders, focusing on the Annual Percentage Rate (APR), interest rate, and closing costs. Having a strong credit score (ideally 740+) significantly helps. Don't hesitate to negotiate fees.

What are closing costs for mortgage refinancing and how much are they?

Closing costs are fees charged by lenders and third parties during the refinancing process, covering items like appraisal fees, title insurance, and origination fees. They typically range from 2% to 5% of the loan amount. You can compare these costs between lenders and potentially negotiate some fees.