Did you know over 42 million Americans have federal student loan debt?

This number shows how important it is to know about borrowing. Whether you want to pay for school, buy a home, or start a business, this guide will help you make smart choices.

We’ll cover all types of loans, what you need to apply, and how to apply. You’ll learn about interest rates, credit scores, and how to pay back your loans. Ready to take charge of your financial future? Let’s start!

Understanding loans can be hard. Did you know personal loans can be approved in days? Or that home equity loans might accept a credit score as low as 500? We’ll share more surprising facts in this guide.

We’ll explain complex terms like APR and debt-to-income ratio in simple ways. You’ll learn how to avoid common mistakes and use your borrowing power wisely. By the end of this guide, you’ll feel confident about any loan application.

Key Takeaways: Ultimate Guide to Loans

Personal loans

Personal loans offer fast access to funds, often within days

Credit scores

Credit scores play a crucial role in loan approval and interest rates

Home equity loans

Home equity loans typically require 20% equity and a 620+ credit score

Federal student loans

Federal student loans have fixed interest rates and flexible repayment options

Understanding loan terms

Understanding loan terms and fees can save you money in the long run

Loan Guide: Understanding the Basics of Loans

Knowing about loans is key to borrowing wisely. Let’s explore what loans are, how they work, and the main parts of your debt.

What is a Loan?

A loan is money you borrow with a promise to pay it back. It’s a tool for reaching goals, like buying a home or starting a business. Loans vary, each for different needs.

How Loans Work

When you get a loan, you get cash upfront. Then, you pay back the cash plus interest over time. The payback period depends on the loan type. For instance, personal loans are usually $1,000 to $50,000, paid back in 12 to 60 months.

Principal vs Interest

It’s important to know about principal and interest. The principal is the amount you borrow. Interest is the cost of borrowing, shown as a percentage of the principal. Here’s a simple explanation:

| Component | Description | Impact on Loan |

|---|---|---|

| Principal | Original borrowed amount | Decreases as you make payments |

| Interest | Cost of borrowing | Adds to total repayment amount |

Remember, your payment history is 35% of your credit score. Paying on time for both principal and interest is vital for a good financial health. Learning these basics helps you make smarter borrowing choices.

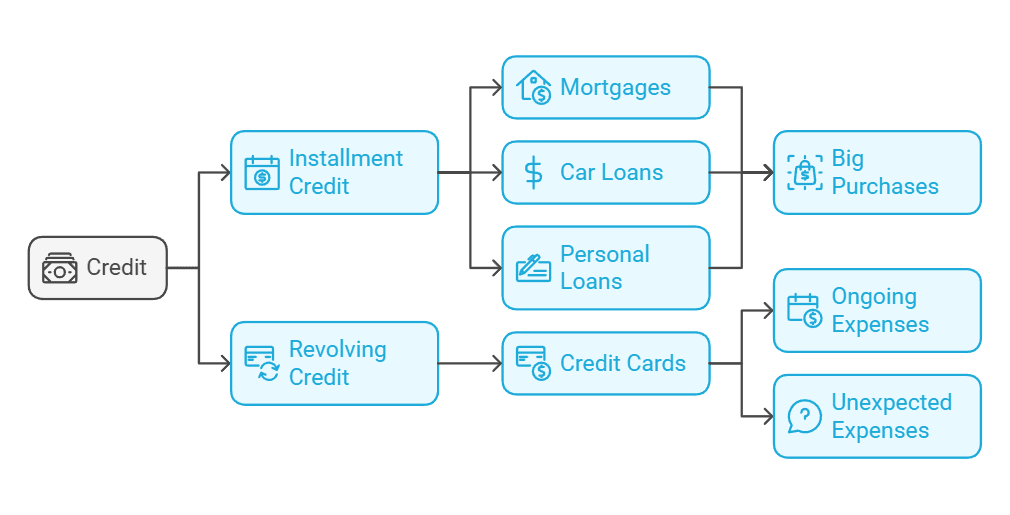

Types of Credit: Installment vs Revolving

Credit comes in two main types: installment and revolving. These types affect how you borrow and repay money. Let’s explore the main differences.

Installment credit is a one-time deal. You borrow a fixed amount and pay it back in set chunks over time. Think of mortgages, car loans, or personal loans. They’re ideal for big purchases needing a clear repayment plan.

Revolving credit is more flexible. It’s like a reusable piggy bank. You have a credit limit and can borrow up to it. As you pay it off, you can borrow again. Credit cards are a classic example. They’re great for ongoing or unexpected expenses.

| Feature | Installment Credit | Revolving Credit |

|---|---|---|

| Borrowing Limit | Fixed amount | Credit limit |

| Repayment | Fixed payments | Flexible payments |

| Interest Rates | Generally lower | Often higher |

| Examples | Mortgages, Auto loans | Credit cards, Lines of credit |

Both credit types have benefits. Installment loans often have lower interest rates. Revolving credit offers more flexibility. Your choice depends on your financial needs and spending habits.

Remember, using credit responsibly is crucial. Pay on time, keep balances low, and your credit score will improve!

Secured vs Unsecured Loans

When you need money, you’ll find two main loan types: secured and unsecured. Knowing the difference is key to smart borrowing.

Collateral Requirements

Secured loans need collateral, like a house or car. This asset protects lenders. Unsecured loans don’t need collateral. They depend on your credit score. This makes unsecured loans easier to get for those without valuable assets.

Risk Factors

Secured loans carry a risk of losing your collateral if you can’t pay. Unsecured loans don’t risk your assets but can hurt your credit score if you default. This can make it hard to borrow later.

Interest Rate Differences

Interest rates are a big deal in loan costs. Secured loans usually have lower rates because they’re less risky. Unsecured loans have higher rates to balance out the risk. For instance, secured personal loans might start at 11% per year, while unsecured rates are often higher.

| Loan Type | Interest Rate | Borrowing Limit | Approval Time |

|---|---|---|---|

| Secured | Lower (from 11%) | Higher | Longer |

| Unsecured | Higher | Lower (up to Rs 10 lakh) | Faster (minutes to days) |

Make a choice that fits your financial situation and goals. The right loan can help you without overloading your finances.

Loan Offers Comparison

| Loan Provider | Loan Amount | Approval Time | Payout Speed | Type | CTA |

|---|---|---|---|---|---|

| HonestLoans.net | Up to $50,000 | 5 Minutes | Next Business Day | Installment Loan | |

| Lifefunds.net | Up to $50,000 | Instant Approval | 24 Hours | Personal Loan | |

| MaxCash.com | Up to $50,000 | Same Day | Same Day | Title Loan | |

| CompareMeFunds.com | Varies | Instant Approval | Varies | Loan Comparer | |

| Slam Dunk Loans | Up to $50,000 | 5 Minutes | Next Business Day | Personal Loan | |

| Money Pup Loans | Up to $50,000 | In most cases, within minutes | As soon as the next business day | Personal Loan | |

| Fast Cash Online | Up to $50,000 | Usually within minutes | As soon as the next business day | Personal Loan | |

| FastLoansGroup | Up to $50,000 | Usually within minutes | As soon as the next business day | Personal Loans, Cash Advance Loans, Installment Loans, Emergency Loans |

Ultimate Guide to Loans: Common Types Available

Exploring loan types can feel overwhelming. From mortgage loans to personal and business loans, each has its own role. Let’s explore the most common ones to guide you in making smart borrowing choices.

Mortgage loans are a top pick for those buying homes. In 2024, you need a credit score of at least 620 for conforming loans. The loan limit is $766,550 in most places, with higher limits in expensive areas. FHA loans are flexible, allowing you to get a mortgage with a 580 credit score and just 3.5% down.

Personal loans meet various needs. On average, people have about $19,402 in personal loan debt. These loans are either secured or unsecured, with rates depending on your credit score.

Business loans are crucial for entrepreneurs. SBA loans have lower interest rates and longer repayment periods. For LLC loans, lenders often look for a personal credit score of 600-650. Equipment financing loans let businesses buy essential tools, often using the tools as collateral.

| Loan Type | Key Feature | Credit Score Requirement |

|---|---|---|

| Conforming Mortgage | $766,550 limit (2024) | 620+ |

| FHA Mortgage | 3.5% down payment | 580+ |

| Personal Loan | Flexible use | Varies |

| LLC Loan | Business-specific | 600-650+ |

Knowing about these loan types helps you pick the right one for your financial goals. Each loan has its own terms, rates, and requirements. Always do your research before making a borrowing decision.

Mortgage Loans and Home Financing

Buying a home is a big step. Knowing about mortgage loans is crucial. Let’s dive into home financing and the choices you have.

Conventional Mortgages

Conventional mortgages are common mortgage loans from private lenders. They come in two types: conforming and non-conforming. Conforming loans follow rules from Fannie Mae and Freddie Mac, with limits on amounts and qualifications.

Non-conforming loans, like jumbo loans, have higher rates because they’re riskier for lenders.

Government-Backed Loans

FHA and VA loans are backed by the government. They offer more flexibility. FHA loans need lower down payments and are easier on credit scores.

VA loans are for veterans and their spouses. They have no down payment and good interest rates.

Special Housing Programs

USDA loans help rural homebuyers with low to moderate incomes. They don’t need a down payment but have certain rules. It’s good to look into these if you need different financing options.

| Loan Type | Down Payment | Credit Score | Special Features |

|---|---|---|---|

| Conventional | 3-20% | 620+ | PMI required if down payment |

| FHA | 3.5% | 500-580 | Lower credit score requirements |

| VA | 0% | No minimum | No PMI required |

| USDA | 0% | 640+ preferred | Rural area properties only |

When picking a mortgage, think about loan terms, rates, and your finances. A bigger down payment can lower your loan and rates. Take your time to research and compare to find the right mortgage for your dreams.

Personal Loans and Their Applications

Personal loans are flexible and can be used for many needs. They usually range from $1,000 to $100,000. The interest rates vary, from 6.99% to 35.99% APR. Repayment terms are usually 2 to 7 years.

When applying, lenders look at your credit score, income, and job. The minimum credit score needed is between 580 to 660. They also check if you make at least $12,000 to $25,000 a year.

Many people get personal loans for debt consolidation. This means combining several debts into one, often at a lower interest rate. Some lenders even make direct payments to creditors, making it easier.

Emergency expenses are another reason people get personal loans. Whether it’s a sudden medical bill or a home repair, these loans offer quick access to funds.

| Lender | Best For | APR Range | Loan Amount | Min. Credit Score |

|---|---|---|---|---|

| LightStream | Excellent Credit | 6.99% – 25.49% | $5,000 – $100,000 | 660 |

| SoFi | Fair Credit | 8.99% – 29.99% | $5,000 – $100,000 | 680 |

| Avant | Low Credit | 9.95% – 35.99% | $2,000 – $35,000 | 600 |

Remember, personal loans can be useful but should be used wisely. Always think about if you can pay it back before borrowing.

Business Lending Options

Ready to take your business to new heights? Let’s explore business loans and startup financing. Whether you’re an experienced entrepreneur or just starting, knowing your options is crucial for success.

Small Business Loans

SBA loans are a big deal for small businesses. They offer up to $5 million with interest rates often in single digits. The SBA 7(a) program is popular for its flexible terms and low down payments. But, you’ll need a credit score of at least 680 to qualify.

Startup Financing

New ventures, listen up! Startup financing options are more varied than ever. Online lenders like iBusiness Funding offer up to $500,000 with terms up to 84 months. Private investors can also be a great option if they believe in your idea.

Business Line of Credit

Need flexibility? A business line of credit might be what you need. Wells Fargo Small Business Advantage® offers up to $50,000, great for managing cash flow or unexpected opportunities. It’s like having a financial safety net at your fingertips.

| Loan Type | Max Amount | Down Payment | Term Length |

|---|---|---|---|

| SBA 7(a) | $5 million | 10-20% | Up to 10 years |

| SBA 504 | $5.5 million | 10% | Up to 25 years |

| Online Term Loan | $500,000 | Varies | Up to 84 months |

Remember, every business is different. Your ideal financing solution depends on your specific needs, credit history, and growth plans. Don’t settle – explore your options and find the business loan that will propel your company forward!

Student Loans and Education Financing

Understanding student loans can be challenging. There are federal and private loans to choose from. Knowing your options helps you make smart financial decisions for your education.

Federal Student Loans

Federal loans are a popular choice for many students. They have fixed interest rates and flexible repayment plans. For the 2024-2025 school year, undergraduate Direct Stafford Loans have a 6.53% interest rate.

These loans also have an origination fee of 1.057%, taken out before you get the money.

How much you can borrow depends on your status. Dependent undergrads can borrow up to $31,000. Independent students can borrow up to $57,500. To apply, you need to fill out the Free Application for Federal Student Aid (FAFSA).

Private Student Loans

Private loans help when federal aid isn’t enough. They have variable rates, from 4% to 18%. Private loans often need a cosigner and may not offer flexible repayment options like federal loans.

| Loan Type | Interest Rate | Repayment Term |

|---|---|---|

| Federal Undergraduate | 6.53% | 5-25 years |

| Federal Graduate | 8.08% | 5-25 years |

| Private | 4%-18% | Varies by lender |

Parent PLUS Loans

Parent PLUS loans are for parents helping with their child’s education. They have a higher interest rate, at 9.08% for 2024-2025. They also have higher origination fees than other federal student loans.

With over $1.6 trillion in student loan debt, borrowing wisely is key. Think carefully about your options and only borrow what you need for school.

Auto Loans and Vehicle Financing

Buying a car is a big decision. Understanding auto loans is key. There are many types of vehicle loans, each tailored to different needs. Whether you want a new car or a used one, there are plenty of financing options.

New car loans usually have lower interest rates. This is because new cars are more valuable and less likely to break down. Manufacturers also offer deals like zero-percent financing or cash rebates.

Used car loans might have smaller loan amounts and lower monthly payments. But, the interest rates can be higher. This is a trade-off between saving money upfront and paying more in the long run.

“Your credit score is your financial report card. It can make or break your auto loan terms.”

Credit unions often offer great deals on auto loans. They usually have lower rates and more flexible terms than banks. In fact, some credit unions have been named the best auto loan providers for over a decade.

Let’s look at some numbers:

- APRs can be as low as 3% for excellent credit

- Average new car loan rate: 4.33%

- Average used car loan rate: 8.62%

- Loan terms range from 12 to 84 months

Be careful with long-term loans (84 months). They can lead to a lot of interest. Always do the math before you sign. And watch out for fees like application, origination, and prepayment fees.

Are you ready to explore vehicle financing? First, check your credit score. Then, compare offers from banks, credit unions, and online lenders. Your perfect auto loan is waiting for you!

Understanding Loan Terms and Interest Rates

It’s important to understand loan terms and interest rates. This knowledge helps you make smart borrowing choices. Let’s explore the key points that affect your loan and your finances.

Fixed vs Variable Rates

When you borrow money, you’ll see fixed and variable rates. Fixed rates mean your payments stay the same. Variable rates can change with the market.

As of January 2025, US mortgage rates were near 7%. This shows how crucial it is to think about rates.

APR Explained

Annual Percentage Rate (APR) shows the full cost of a loan. It includes the interest and fees. This helps you see the total cost of borrowing.

Banks and credit card companies use APR to compare loans. It makes it easier to pick the best option.

Loan Term Length Impact

The length of your loan affects your payments and interest. Shorter terms mean higher monthly payments but less interest. Longer terms lower your monthly payments but increase the interest.

| Loan Type | Interest Rate | APR | Term Length |

|---|---|---|---|

| Fixed-Rate Mortgage | 6.5% | 6.8% | 30 years |

| Adjustable-Rate Mortgage | 5.5% (initial) | 5.9% | 5/1 ARM |

| Personal Loan | 8% | 9.2% | 5 years |

Remember, compound interest affects the cost of borrowing. It helps savers but increases costs for borrowers. Always think about your goals and the market when choosing loan terms and rates.

Credit Scores and Loan Approval

Your credit score is very important for loan approval. Lenders use these scores to see if you’re a good borrower. Knowing how credit scores affect your loans is crucial for getting good deals.

Loan requirements change based on the type of loan. For instance, FHA loans might accept scores as low as 580. But, conventional mortgages usually need a score of 620 or more. Your score also affects the interest rates you get. Here’s how personal loan rates compare with credit scores:

| Credit Score Range | Typical Interest Rate |

|---|---|

| 720-850 (Excellent) | 10.73%-12.50% |

| 690-719 (Good) | 13.50%-15.50% |

| 630-689 (Fair) | 17.80%-19.90% |

| 300-629 (Poor) | 28.50%-32.00% |

Boosting your credit score can lead to better loan options. Pay bills on time, lower your debt, and avoid new credit checks. These actions can raise your score and improve your loan approval chances.

But, credit scores aren’t the only thing lenders look at. They also check your income, debt-to-income ratio, and job history. Still, a high credit score is a big plus for getting good loan terms.

The Loan Application Process

Applying for a loan can seem tough, but with the right steps, it’s easier. We’ll cover the main steps and what you need to do to succeed.

Required Documentation

When you apply for a personal loan, you’ll need some documents. These are usually:

- Proof of income (pay stubs, tax returns)

- Bank statements

- Identification (driver’s license, passport)

- Proof of address (utility bills, lease agreement)

- Employment verification

Application Steps

The loan application process has a few main steps:

- Check your credit score

- Compare loan offers

- Gather required documents

- Complete the application form

- Submit for review

- Await approval decision

Common Mistakes to Avoid

Avoid these mistakes when applying for a loan:

- Submitting incomplete applications

- Providing inconsistent financial information

- Applying for multiple loans at once

- Ignoring the fine print

- Borrowing more than you can repay

A good credit score can get you better loan terms. You can get a free credit report from each major bureau once a year. With the right preparation and focus, you’ll have a better chance of getting approved and getting good terms.

Loan Repayment Strategies

Learning how to manage your loan payments can save you money and help you pay off debt faster. Let’s look at smart ways to pay and the benefits of paying off your loan early. This will help you on your financial path.

Payment Options

Lenders have different ways for you to pay back your loan. Most people pay monthly, but biweekly payments can save you money. This method means you make an extra payment each year, cutting down on time and interest.

Some lenders also give a discount for automatic payments. This can be up to 0.50 percent off your interest rate.

Early Repayment Benefits

Paying off your loan early can save you a lot of money. For instance, adding $100 a month to a $10,000 loan at 4.5% interest can save you about five and a half years. When you make extra payments, tell your loan servicer to apply them to the principal. This speeds up your repayment.

Handling Payment Difficulties

If you’re having trouble making payments, don’t worry. There are many ways to handle debt. Credit counseling agencies offer free advice on how to manage your payments. You might also look into debt consolidation or refinancing for better terms.

The most important thing is to act quickly and talk to your lender. They can help you find the best solution for your situation.

| Strategy | Benefit |

|---|---|

| Biweekly Payments | Extra annual payment |

| Autopay | Interest rate discount |

| Extra Payments | Faster debt payoff |

By using these strategies, you can take charge of your loan repayment. This will lead you to financial freedom. Remember, every little bit counts on your way to being debt-free.

Debt Consolidation and Refinancing

Struggling with multiple debts? Debt consolidation could be your way out. It combines all your debts into one, often with a lower interest rate. But is it the right choice for you?

Let’s look closer. Debt consolidation loans last from one to seven years. The interest rates vary from 6% to 36%. The best part? When your monthly payments are less than 50% of your income.

Now, let’s talk about loan refinancing. It’s about swapping your current loan for a new one with better terms. This can save you money and make your finances easier. But, you need good credit for the best rates.

Here are some interesting facts:

- Average credit card rate: 20.27%

- Average personal loan rate: 12.29%

- Balance transfer cards: 0% interest for 15-21 months

Wow, right? Consolidation loans can be from $1,000 to $50,000. Some even offer terms up to seven years. But, be careful of those origination fees!

Remember, consolidation isn’t a magic wand. It’s a tool. Use it wisely, and you’ll be on your way to financial stability.

Ready to take control of your debt? Don’t wait. Start looking into your consolidation options today. Your future self will thank you!

| Consolidation Method | Pros | Cons |

|---|---|---|

| Personal Loan | Fixed rates, single payment | Requires good credit |

| Balance Transfer Card | 0% intro APR | Transfer fee, short promo period |

| Home Equity Loan | Lower interest rates | Risk of losing home |

High-Risk Loans to Avoid

When money is tight, high-risk loans might seem like a quick solution. But, they can actually make things worse. These high-risk loans include payday loans, title loans, and predatory lending. Let’s look at why you should steer clear of them.

Payday Loans

Payday loans have very high interest rates and are meant to keep you in debt. You might borrow $500, but end up owing thousands. It’s best to avoid these loans altogether.

Title Loans

Title loans use your car as collateral. If you can’t pay, you could lose your car. These loans have high fees and interest rates, sometimes over 300% APR. Losing your car isn’t worth it.

Predatory Lending Practices

Predatory lending targets people who are already in a tough spot. Be careful of:

- Hidden fees

- Pressure to borrow more than you need

- Promises that sound too good to be true

If something doesn’t feel right, trust your instincts and walk away.

| Loan Type | Average APR | Risk Level |

|---|---|---|

| Payday Loans | 400% | Extremely High |

| Title Loans | 300% | Very High |

| Predatory Personal Loans | 100%+ | High |

Don’t fall into these traps. Look into safer options like credit union loans or peer-to-peer lending. Your future self will be grateful for avoiding these financial dangers.

“If you’re considering a high-risk loan, stop and think. There’s almost always a better option.”

Conclusion

Now that you’ve read this ultimate guide to loans, you’re ready to make informed borrowing decisions. Smart loan management is more than just getting money. It’s about using financial tools to build a better future.

Every loan type, from mortgages to business loans, has its own rules and risks. Your job is to weigh these against your needs and what you can handle. Crunching numbers, like understanding DSCR, can help you in property investments.

Whether you’re looking at a $24,000 education loan from HDFC Bank or an SBA loan for your restaurant, make each decision carefully. The right loan can help you succeed, but only if you manage it well. So, take control of your finances – your future will be grateful!

Frequently Asked Questions

What's the fastest way to get a loan?

The absolute fastest way to get a loan is typically through online lenders, with some offering funds in 24 hours or less. Payday loans and cash advance apps are also very fast, but come with extremely high interest rates. If you have decent credit, an online personal loan is often the best speedy option.

Can I get a loan with bad credit?

Yes, it's possible to get a loan even with bad credit. Options include lenders specializing in bad credit loans (though expect higher interest rates), secured loans using collateral, finding a cosigner with good credit, or exploring peer-to-peer lending platforms.

How much can you borrow with a personal loan?

Personal loan amounts can vary widely, typically ranging from $1,000 up to $100,000. The exact amount you can borrow depends heavily on the lender and your creditworthiness, which is determined by factors like your credit score, income, and debt-to-income ratio.

What is the difference between APR and interest rate?

The interest rate is simply the cost to borrow the principal amount. The APR (Annual Percentage Rate), however, is the true annual cost of the loan because it includes the interest rate plus any additional fees, such as origination fees. Comparing APRs gives you a more accurate picture of the total cost.

How long does mortgage approval take?

Getting pre-approved for a mortgage usually takes a few days to about a week. The entire process from application to closing typically takes 30-60 days, but this timeline can be longer depending on the lender, your financial situation, and market conditions.

Can you pay off a loan early?

Generally, yes, you can pay off a loan early. However, it's crucial to check your specific loan agreement as some lenders, particularly for mortgages or auto loans, may charge prepayment penalties. Paying off early saves you money on interest over the life of the loan, provided there isn't a significant penalty.

What's the difference between fixed-rate and variable-rate loans?

With a fixed-rate loan, the interest rate remains the same for the entire duration of the loan, providing predictable monthly payments. With a variable-rate loan, the interest rate can fluctuate based on market conditions, meaning your monthly payments could go up or down.

Tools and Resources