Feeling stuck without a bank account? You’re not alone. Millions of Americans struggle to get loans when banks seem unreachable. This guide will show you how to find loans without a bank account. You’ll learn about alternative lending options that can help your financial situation1.

The world of no-bank-account loans is bigger than you think. With about 6 million unbanked Americans, knowing your borrowing options is key1.

Need money fast for an unexpected expense? Alternative lending solutions can help. You have more options than just traditional bank loans.

Key Takeaways: Where to Get Loans Without a Bank Account

- No bank account doesn’t mean no loan access

- Multiple alternative lending options exist

- Understanding requirements is crucial for approval

- Emergency funds can be secured through creative financing

- Credit score isn’t the only factor in loan eligibility

Understanding Loans Without Bank Accounts

For unbanked Americans, finding loans can be tough. Banks often ask for bank accounts, which blocks many from getting loans. It’s key to know these hurdles to find other loan options.

We've created this table to help you compare different online loan matching services. These services can connect you with a network of lenders, offering various types of loans to fit your needs.

In this table, you'll find key details such as the loan provider's name, the range of loan amounts they can help you find, typical approval and payout speeds, and the types of loans they offer.

To get a complete picture, including details about potential costs like APRs and fees, specific credit requirements, the application process, security information, and other considerations, we encourage you to visit the related service's page directly.

Please remember that these services are not direct lenders, so your specific loan terms will be determined by the actual lender, and those details can vary. Please note that we may receive an affiliate commission if you click on links or apply through this page, however, this does not influence our recommendations.

We hope this comparison table helps you in your search!

Why Lenders Require Bank Accounts

Banks need bank accounts for important reasons:

- To check if you can handle money well

- To set up automatic payments

- To see if you’re a good risk

- To make sending and getting money easier

The Reality of Unbanked Americans

About 6 million Americans don’t have bank accounts, making loans hard to get2. They face:

- Fewer financial options

- Higher costs for borrowing

- Less chance to build credit

Impact on Loan Accessibility

Without a bank account, loan choices shrink. Personal loans can be up to $50,000, but you need a bank account to get them2. The average interest rate is around 9.34%, making loans appealing to many3.

“Financial exclusion is not just about money—it’s about opportunity.” – Financial Inclusion Expert

Knowing these obstacles is the first step to finding loans that fit your financial needs.

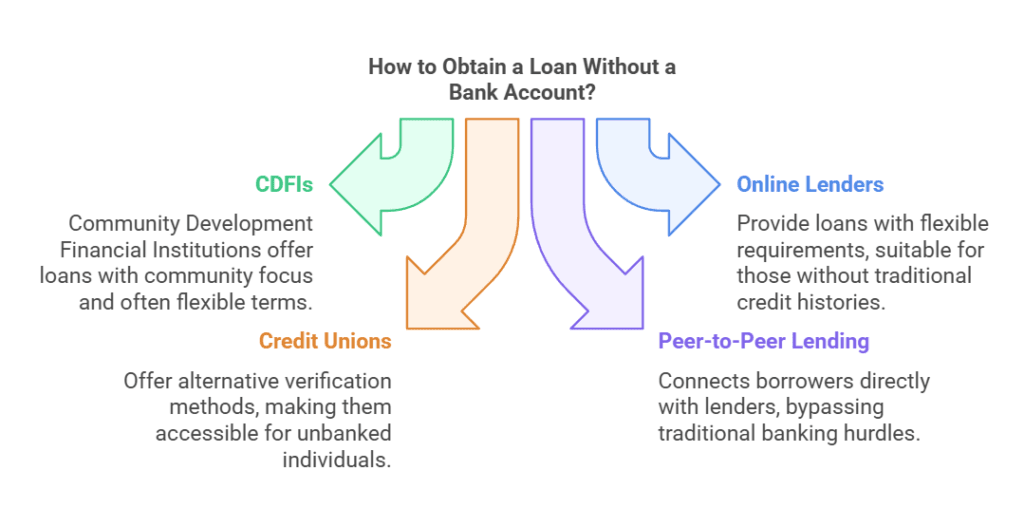

Where to Get Loans Without a Bank Account

Looking for loans without a bank account can be tough. But, there are many no-bank-account loan options for those who want to find alternative ways to borrow money without the usual banking hurdles.

Unbanked borrowers have a few smart ways to get the money they need:

- Community Development Financial Institutions (CDFIs)

- Online lenders with flexible requirements

- Credit unions with alternative verification methods

- Peer-to-peer lending platforms

Let’s look at some great ways to get loans without a bank account. These strategies can help open up financial opportunities4.

| Lender | Loan Amount Range | Minimum Credit Score | APR Range |

|---|---|---|---|

| Upstart | $1,000 – $50,000 | 300 or No Credit | 7.40% – 35.99% |

| Upgrade | $1,000 – $50,000 | 580 | 9.99% – 35.99% |

| LendingClub | $1,000 – $40,000 | 660 | 8.91% – 35.99% |

Pro tip: Some lenders look at other ways to check your credit, not just bank accounts5.

“Financial empowerment isn’t about having a bank account—it’s about understanding your options.” – Financial Expert

When looking at no-bank-account loan options, think about things like origination fees, repayment terms, and how fast you can get approved4. Online platforms often offer more flexible options for those without bank accounts5.

Types of No-Bank-Account Loan Options

Getting loans without a bank account can seem tough. But, there are many ways to get the money you need. We’ll look at different options that offer quick cash for those who can’t use banks.

You don’t have to stop looking for financial help just because banks won’t help. There are new ways to get money when you really need it.

CDFI Loans and Community Resources

Community Development Financial Institutions (CDFI loans) are great for those outside the bank system. They focus on helping people who are often overlooked. These loans are made to support those in need6.

- Local credit unions with special loan programs

- Nonprofit groups with flexible rules

- Money for specific community needs

Credit Card Cash Advances

Credit card cash advances are a fast way to get money without a bank account. You can take out cash based on your credit limit7.

| Cash Advance Feature | Details |

|---|---|

| Typical Advance Limit | Percentage of total credit line |

| Transaction Fees | 3-5% of withdrawn amount |

| Interest Rates | Often higher than standard credit purchases |

Vehicle Title and Pawn Shop Loans

Vehicle title and pawn shop loans are based on your property. They’re for those without bank accounts6. These loans let you use your stuff as collateral for quick approval.

- Vehicle title loans range from $100 to $5,5006

- Typical repayment terms span 15 to 30 days6

- Pawn shop loans give cash based on item value

“Your financial potential isn’t defined by a bank account, but by your resourcefulness and determination.” – Financial Empowerment Strategist

Remember: Each loan option has its own risks and benefits. Always check the terms and understand the financial impact before you decide.

Top Lenders Offering No-Bank-Account Loans

Finding loans without a bank account can be tough. InstantLoanFinder.com helps you find lenders who get your financial needs.

Here are some top lenders for those with limited banking access:

- Avant: Offers personal loans with great flexibility8

- Loan amounts from $2,000 to $35,000

- Interest rates between 9.95% and 35.99%

- Loan terms spanning 24 to 60 months

- OneMain Financial: Focuses on alternative lending solutions8

- Loan ranges from $1,500 to $20,000

- Interest rates between 18.00% and 35.99%

- Flexible loan durations from 24 to 60 months

Pro Tip: Upstart is great for those with little credit history8. They offer loans from $1,000 to $50,000 with new credit checks.

Not having a traditional bank account doesn’t mean you can’t access financial resources!

For alternative loan options, consider these:

- LendingPoint: Offers loans up to $36,5008

- Oportun: Provides quick funding with loans between $300 and $10,0008

Be aware of fees and terms when looking at no-bank-account loans. Most lenders do soft credit checks during prequalification8. This won’t hurt your credit score.

We've created this table to help you compare different online loan matching services. These services can connect you with a network of lenders, offering various types of loans to fit your needs.

In this table, you'll find key details such as the loan provider's name, the range of loan amounts they can help you find, typical approval and payout speeds, and the types of loans they offer.

To get a complete picture, including details about potential costs like APRs and fees, specific credit requirements, the application process, security information, and other considerations, we encourage you to visit the related service's page directly.

Please remember that these services are not direct lenders, so your specific loan terms will be determined by the actual lender, and those details can vary. Please note that we may receive an affiliate commission if you click on links or apply through this page, however, this does not influence our recommendations.

We hope this comparison table helps you in your search!

Each lender has its own rules. Some might need minimum annual income or certain verification steps. Always check the details and compare to find the best loan for you.

Costs and Considerations of Bank-Free Borrowing

Exploring bank-free borrowing costs needs careful planning. Knowing about loan interest rates and repayment terms is key. This knowledge helps protect your financial future.

Looking into alternative lending options brings up several financial points. These points affect your borrowing experience. Personal loans offer funding without needing a bank.

Interest Rates and APR Ranges

Personal loan interest rates change based on your financial situation. Rates can go from 6.94% to 35.99%9. Those with great credit might get rates between 10.73% and 12.50%10.

Additional Fees and Charges

Bank-free borrowing means knowing about extra costs. Origination fees can be 1% to 12% of the loan amount10. Some lenders, like OneMain Financial, charge between $25 and $5009.

| Fee Type | Typical Range |

|---|---|

| Late Payment Fees | $25 to $30 or 15% of late amount9 |

| Origination Fees | 1% to 12% of loan amount10 |

Repayment Terms and Conditions

Repayment options differ among lenders. Most personal loans last 5-7 years10. Some, like Rocket Loans, offer 36 or 60-month fixed terms9.

“Knowledge of loan terms is your most powerful financial tool.” – Financial Expert

Pro Tip: Always compare different lenders. Review all loan terms and understand fees before choosing a bank-free option.

Application Process and Requirements

Getting a loan without a bank account can seem tough, but it’s doable. Knowing what lenders need is key to getting your finances in order11. They’ll look at other ways to check if you can pay back the loan.

Here’s what you need for your loan application:

- Proof of income (pay stubs, tax returns)

- Government-issued identification

- Alternative contact information

- Employment verification

Your credit score matters a lot for getting a loan. Loan interest rates can be from 6.99% to 35.99% based on your credit11. Those with great credit get better deals.

“Financial success starts with understanding your options and presenting yourself strategically.” – Financial Empowerment Experts

If you don’t have a bank account, try these:

- Look into lenders that work with non-traditional banking

- Get all your income documents ready

- Think about getting a secured loan

- Be ready to talk about your financial situation

Loan amounts can be from $2,000 to $100,00011. Fees for starting the loan can be 1% to 10% of the loan amount11. Show that you’re financially stable, even without a bank account.

Pro tip: Some lenders might ask for prepaid debit cards or money orders. Be ready to talk about these during your application12.

Alternative Financial Solutions

When traditional bank loans seem out of reach, you have many other options. These creative strategies can help you deal with financial challenges without traditional loans.

Family and Friend Loans

Family loans offer a personal way to borrow money. These informal loans can provide quick help with more flexible terms. Here are some key tips for family loans:

- Document the loan agreement in writing

- Establish clear repayment expectations

- Set realistic interest rates

- Treat the arrangement professionally

“Personal relationships and financial transactions require mutual respect and transparency.”

Local Assistance Programs

Local assistance programs offer financial help for those facing economic hard times. Many communities have unique financial solutions through different organizations13:

- Community development financial institutions (CDFIs)

- Non-profit credit counseling services

- Municipal emergency assistance programs

Payment Extensions with Service Providers

When unexpected expenses come up, asking for payment extensions can be a smart move. Many service providers offer flexible plans:

| Provider Type | Potential Extension Options |

|---|---|

| Utility Companies | Deferred payment plans |

| Medical Providers | Interest-free payment schedules |

| Telecommunications | Temporary billing adjustments |

Pro tip: Always communicate proactively with service providers before missing payments.

By looking into these alternative financial solutions, you can find new ways to handle unexpected money problems without traditional bank loans.

Conclusion: Where to Get Loans Without a Bank Account – Your Next Steps

Your journey to financial empowerment is clear. You’ve found ways to get loans without a bank account14. Options like cash advance loans, title loans, and pawn shop alternatives are available14.

Choosing where to get loans without a bank account needs careful planning14. Look at interest rates, repayment terms, and any hidden fees14. Sites like RadCred can help you find lenders who get your financial situation14.

Your financial journey starts with smart choices14. Know what you need, understand the requirements, and pick options that fit your goals14. Make sure you can afford what you borrow to keep your finances healthy14. Now, start your journey to financial strength by making informed decisions and unlocking your potential.

Frequently Asked Questions

Can you get a loan if you don't have a bank account?

Yes, definitely. While traditional banks require bank statements, many alternative lenders like online platforms, peer-to-peer lenders, and pawn shops offer loans specifically for individuals without bank accounts.

What types of loans are available if you don't have a bank account?

Several options exist, including title loans (using your car title as collateral), pawn shop loans (trading valuables), personal loans from certain online lenders (based on income/employment), payday loans, cash advances (use cautiously due to fees), and some installment loans.

How do lenders give you the loan money without a bank account?

Lenders use various methods. They might provide a prepaid debit card loaded with the funds, offer cash or money orders, allow pickup at a physical location, or transfer money to a digital wallet.

What do you need to qualify for a loan without a bank account?

Requirements vary but usually include proof of income (pay stubs, tax returns), a valid government ID, and proof of address. Some may ask for references or alternative credit data like utility/rent payment history to assess your risk.

Are interest rates higher for loans if you don't have a bank account?

Generally, yes. Lenders perceive borrowers without bank accounts as higher risk and offset this with increased interest rates and fees. It's vital to compare APRs and the total loan cost from multiple lenders, as they can be significantly higher than traditional loans.

How can I avoid scams when getting a loan without a bank account?

Be vigilant. Use reputable lenders with good track records. Check online reviews and their Better Business Bureau (BBB) rating. Be suspicious of anyone pressuring you or offers that seem too good to be true.

Can taking out a loan without a bank account help build credit?

It depends on the lender. Some alternative lenders report your payment history to credit bureaus, which can help build credit. Others do not. Always ask the lender about their reporting practices beforehand.