Every spiritual journey starts with financial steps. Churches growing their mission need to understand who is responsible for loans. The world of religious financing can seem complex, but knowing it can turn uncertainty into a chance for growth1.

Church leaders face big challenges in making financial decisions. They need a clear guide to help them get church loans without losing trust from their community. This guide will show you how to navigate the process of securing church loans while keeping everything financially sound.

Religious groups must handle finances wisely. Pope Francis stresses the need for careful money management to support community work1. Knowing who is responsible for church loans is not just about money. It’s about using resources well.

Key Takeaways: Who Is Responsible for a Church Loan

- Church loan responsibility requires collaborative leadership

- Financial transparency builds congregational trust

- Strategic borrowing supports ministry expansion

- Legal compliance is essential in church financing

- Proper financial oversight protects organizational mission

Understanding Church Loan Basics and Financial Responsibilities

Churches need to plan carefully when looking for loans. They face special financial hurdles for growth, updates, or new projects church borrowing regulations are key in this journey.

We've created this table to help you compare different online loan matching services. These services can connect you with a network of lenders, offering various types of loans to fit your needs.

In this table, you'll find key details such as the loan provider's name, the range of loan amounts they can help you find, typical approval and payout speeds, and the types of loans they offer.

To get a complete picture, including details about potential costs like APRs and fees, specific credit requirements, the application process, security information, and other considerations, we encourage you to visit the related service's page directly.

Please remember that these services are not direct lenders, so your specific loan terms will be determined by the actual lender, and those details can vary. Please note that we may receive an affiliate commission if you click on links or apply through this page, however, this does not influence our recommendations.

We hope this comparison table helps you in your search!

Types of Church Loans Available

Churches have many ways to get funds for growth and community help. The main types of loans are:

- Construction loans for new buildings

- Refinancing current debts

- Loans for improving facilities

- Funds for new equipment and tech

About 75% of churches borrow for building or updating2. Loan sizes vary from $50,000 to over $1 million, based on the project2.

Key Stakeholders in Church Financing

Church financing needs the input of several important people:

| Stakeholder | Responsibility |

|---|---|

| Church Leadership | Planning the church’s finances |

| Board of Directors | Checking and approving plans |

| Financial Advisors | Helping with loan details |

Interestingly, 60% of church leaders say they don’t fully get loan terms2. This shows how crucial expert financial advice is.

Legal Requirements for Church Borrowing

“Financial transparency is the cornerstone of responsible church leadership”

Churches must follow certain laws and rules when borrowing money. Important things to remember include:

- Following nonprofit financial rules

- Providing clear financial info

- Getting approval from the congregation

- Keeping tax-exempt status

Churches that spend 5% to 10% of their budget on debt show good financial management2. Knowing these rules helps keep finances stable.

Who Is Responsible for a Church Loan

Church loans are not just handled by one person. They involve many people working together3. This teamwork is key to managing church finances well.

👉The main people involved in handling church loans are:

- Church leadership team

- Board of directors

- Finance committee members

- Congregation representatives

“Financial stewardship is a shared journey of trust and accountability”

Church administrators have a big job. They must deal with complex money issues while keeping things clear and in order4. For example, the Presbyterian Church (USA) has 8,572 churches. They all keep an eye on their money3.

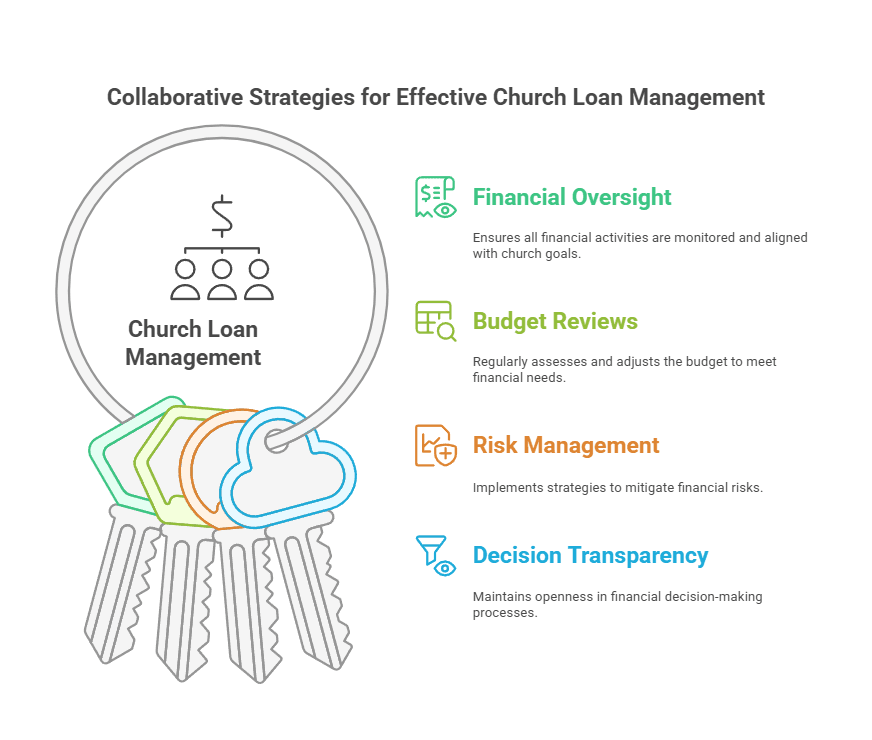

Important parts of handling church loans include:

- Comprehensive financial oversight

- Regular budget reviews

- Risk management strategies

- Transparent decision-making processes

Managing church loans well needs teamwork. Your church’s financial health depends on planning, responsible borrowing, and everyone working together3.

The Role of Church Administration in Loan Management

Church financial management is more than just keeping track of money. Your team is key to keeping your church financially healthy. Managing loans can be tough, but church loan processes need careful handling.

Churches need to watch over their finances closely. They must have strong systems to keep their money safe and support their work.

Financial Oversight and Documentation

Church administrators have big jobs in managing money. They are responsible for:

- Maintaining accurate financial records

- Preparing tax documents

- Tracking loan payments

- Following financial rules

Managing money has gotten harder. Churches need better ways to track their finances5. Experts are needed for these jobs, bringing their knowledge to help manage money5.

Budget Planning and Debt Service

Planning the budget is key when dealing with church loans. Your team must find a balance between spending on ministry and paying off loans. They need to create a budget that is both flexible and strict.

| Budget Component | Recommended Allocation |

|---|---|

| Loan Repayment | 25-30% of Total Budget |

| Ministry Operations | 50-60% of Total Budget |

| Emergency Reserves | 10-15% of Total Budget |

Risk Management Strategies

Churches face big financial risks. Less than 30% of risk plans work well6. Your team must come up with strong plans to avoid financial problems.

“Financial stewardship is not just about managing money, but about honoring the trust placed in us by our congregation and community.”

By using strict church financial management practices, your church can build a strong financial base. This will help support your long-term goals5.

Church Leadership’s Financial Obligations

Church leaders have a big job, not just spiritual guidance. They must think strategically and manage money well. They are the guardians of their congregation’s resources7.

The church board has to watch over the finances carefully. This is crucial for the future of your ministry. To do this well, you need a solid plan:

We've created this table to help you compare different online loan matching services. These services can connect you with a network of lenders, offering various types of loans to fit your needs.

In this table, you'll find key details such as the loan provider's name, the range of loan amounts they can help you find, typical approval and payout speeds, and the types of loans they offer.

To get a complete picture, including details about potential costs like APRs and fees, specific credit requirements, the application process, security information, and other considerations, we encourage you to visit the related service's page directly.

Please remember that these services are not direct lenders, so your specific loan terms will be determined by the actual lender, and those details can vary. Please note that we may receive an affiliate commission if you click on links or apply through this page, however, this does not influence our recommendations.

We hope this comparison table helps you in your search!

- Develop clear financial policies

- Make smart budget plans

- Be wise when taking loans

- Plan for risks

“The borrower is slave to the lender” – Proverbs 22:7

Being a good financial steward means making smart choices. These choices should help your church’s mission. By doing this, you protect your congregation’s spiritual and financial well-being7.

Some important tasks include:

- Regular financial reports

- Managing debt

- Telling the congregation about finances

- Planning for the future

Good church board work is more than just numbers. It’s a trust between leaders and the community7. Your choices today will impact your church’s future for years to come.

Managing Church Assets and Loan Collateral

Managing church properties is more than upkeep. Your religious organization’s assets are key to financial health. They can help your ministry grow and stay stable8.

Knowing how to use your church’s assets can open up financial doors. About 60% of U.S. churches have assets that could be used as loan collateral8. These assets are more than just buildings; they’re strategic tools for your ministry’s success.

Property Valuation Strategies

Getting your property’s value right is key for your church’s assets. Churches that know their property’s worth can get better loan deals8. Consider these factors:

- Location and market conditions

- Building condition and maintenance history

- Potential for future development

- Current real estate market trends

Insurance and Asset Protection

Keeping your church’s assets safe needs good insurance. About 70% of church loans use real estate as collateral8. A solid insurance plan protects these vital resources from unexpected dangers.

“Your church’s assets are more than buildings—they’re the foundation of your ministry’s future.” – Financial Ministry Advisors

Maintaining and Growing Asset Value

Smart asset management boosts your church’s financial health. Churches that manage well and are transparent are 40% more likely to stay financially stable8. Here are some maintenance tips:

- Regular property inspections

- Strategic renovation investments

- Diversifying property uses

- Monitoring market trends

Church property management is not just about keeping things running. It’s about finding ways to grow your ministry and stay financially strong.

Financial Stewardship and Congregation Involvement

Good church financial management is not just for leaders. It needs everyone’s help. Financial transparency is key to trust in your community9. More than 70% of people want to know everything about church money, showing how important it is to share9.

Churches can do better with money by getting everyone involved:

- Regular financial reports

- Open talks about the budget

- Workshops on money matters

- Updates on loans

Congregational financial participation makes a church’s money work better. Churches that get their members involved in planning see a 35% better budget use9. This makes managing money a team effort, not just for leaders.

“Financial transparency isn’t just about numbers – it’s about building trust and shared responsibility.”

Here are some important steps to take:

- Have meetings every quarter to review finances

- Set up a finance committee for the whole church

- Teach people about money

By focusing on church financial openness, you’ll use resources well and bring your community closer together9.

| Financial Practice | Impact |

|---|---|

| Regular Financial Reviews | 60% Fraud Reduction |

| Member Financial Training | 35% Budget Adherence |

| Transparent Reporting | 80% Community Trust |

Conclusion

Your journey to successful church loan management is more than just about money. It’s about growing your ministry in a lasting way. Church loan management best practices help you build a strong financial base that supports your mission10.

By being open with your finances and managing assets wisely, you turn challenges into chances to grow. This approach helps your church thrive.

Success in religious organizations comes from working together and planning ahead. Everyone in your church, from leaders to members, must help keep finances healthy. Learning about loan management helps your church face financial challenges with confidence10.

Financial care is a never-ending task. Keep learning, manage risks, and talk openly to stay strong. Your church’s financial plan should grow with the economy while staying true to your mission. By following these steps, you’ll not only manage your loan well but also build a strong financial future for your church.

Are you ready to change your church’s financial future? The power of smart planning and teamwork is waiting. Your ministry’s potential is huge, limited only by your dedication to financial excellence.

Frequently Asked Questions

Is the pastor solely responsible for a church loan?

Hell no! The pastor might be the spiritual leader, but when it comes to a church loan, it’s a team sport. You’ve got the board of trustees, the finance committee, and sometimes even the entire congregation involved. It’s about shared responsibility, accountability, and making damn sure the church’s financial future is secure. Some loans even require a personal guarantee.

What is the role of the board of trustees in securing a church loan?

The board of trustees are the financial gatekeepers. They’re the ones who typically authorize the loan, sign the loan documents, and are legally responsible for ensuring repayment. They’re like the church’s financial অভিভাবক, making sure everything is done by the book and in the best interest of the church’s mission.

Can a church get a loan without a personal guarantee?

It’s tough, but not impossible. Lenders prefer a personal guarantee because it gives them extra security. But some specialized lenders understand the nonprofit structure and might offer loans based on the church’s assets, financial history, and projected income. Be prepared to show a solid financial plan and demonstrate your church’s financial health.

What legal documents are required for a church loan?

You’ll need a mountain of paperwork. We’re talking bylaws, articles of incorporation, financial statements, tax-exempt status determination letter (like the 501(c)(3) status from the IRS), meeting minutes authorizing the loan, and a detailed loan proposal. It’s like convincing a judge and jury that your church is a good investment. Check out the website of the Internal Revenue Service (IRS).

How does a church’s credit history affect its ability to get a loan?

Just like individuals, churches have a financial reputation. Lenders will check your church’s credit history to see if you’re a responsible borrower. They might look at your payment history on previous loans, your debt-to-income ratio, and your overall financial stability. A strong history makes you a prime candidate for the best loan terms.

What are the different types of church loans available?

You’ve got options! There are construction loans for building or expanding, mortgage loans for purchasing property, refinance loans to get better rates, and even equipment loans for things like sound systems or vans. Some lenders specialize in church financing and understand your unique needs.

How much of a down payment do churches need for a loan?

It varies, but typically lenders want to see a down payment of 20-30% of the loan amount. This shows you’re serious and have skin in the game. The more you put down, the less risk for the lender, and the better terms you’ll likely get. For smaller, unsecured loans, a down payment might not be necessary.

What is the role of the finance committee in managing a church loan?

The finance committee are the financial watchdogs. They work with the pastor and the board to create a budget, track loan payments, ensure compliance with loan terms, and keep the congregation informed. They’re the ones making sure the church doesn’t bite off more than it can chew.

Can a church use its building as collateral for a loan?

Absolutely! Your church building, land, and other assets can be used as collateral to secure a loan. This can help you get a larger loan amount or a lower interest rate. But be careful – if you default, the lender could seize your property.

Where can a church find lenders that specialize in church loans?

Don’t just walk into any bank. Look for lenders who understand the unique needs of churches. Specialized lenders like Griffin Church Loans, Thrivent Church Financing, AG Financial or Evangelical Christian Credit Union (ECCU) often offer better terms and have experience working with nonprofit organizations. You can also ask other churches for recommendations. Check out for example Griffin Church Loans, Thrivent Church Financing, AG Financial and Evangelical Christian Credit Union (ECCU).