Financial struggles can really get you down when you’re in a legal battle. Waiting for a settlement while you can’t pay your bills feels like forever. A pre-settlement loan could be your rescue, but getting it isn’t a sure thing1.

Getting a lawsuit funding rejection isn’t just random. Lenders carefully check each case. They look at liability, damages, and insurance to see if it’s worth the risk2.

Knowing why a pre-settlement loan might be turned down can help you improve your chances. Funding companies dig deep into your case and its financial impact1.

Dealing with pre-settlement loan denial needs careful planning. Having all the right documents can really help your case. It could mean the difference between getting the financial help you need and not2.

We've created this table to help you compare different online loan matching services. These services can connect you with a network of lenders, offering various types of loans to fit your needs.

In this table, you'll find key details such as the loan provider's name, the range of loan amounts they can help you find, typical approval and payout speeds, and the types of loans they offer.

To get a complete picture, including details about potential costs like APRs and fees, specific credit requirements, the application process, security information, and other considerations, we encourage you to visit the related service's page directly.

Please remember that these services are not direct lenders, so your specific loan terms will be determined by the actual lender, and those details can vary. Please note that we may receive an affiliate commission if you click on links or apply through this page, however, this does not influence our recommendations.

We hope this comparison table helps you in your search!

Key Takeaways: Why Would A Pre Settlement Loan Be Denied

- Pre-settlement funding is not guaranteed for all plaintiffs

- Lenders evaluate case strength and financial risk carefully

- Comprehensive documentation significantly impacts approval chances

- Insurance coverage plays a crucial role in funding decisions

- Responsible borrowing is key to successful funding applications

Understanding Pre-Settlement Funding Basics

Pre-settlement funding is a vital financial help for people in long legal fights. It offers financial support to manage costs while waiting for a lawsuit. Knowing what you need to qualify can greatly help your legal case.

Pre-settlement funding is not a regular loan. It’s a cash advance made for people in legal battles. It has key features:

- Available for many lawsuit types

- Non-recourse financial support

- Repayment depends on case success

Qualifying Legal Cases for Funding

Many legal areas qualify for funding. Here are some examples:

- Personal injury claims

- Workplace accidents

- Medical malpractice

- Wrongful death litigation

- Product liability cases

“Pre-settlement funding turns legal waiting into a strategic chance.”

Funding companies look at each case’s chances of winning. They check things like:

- Case strength

- Potential settlement value

- Documented damages

- Clear liability

Your case’s strength decides if you get funding. They look for cases likely to win and with big payouts3.

To get funding, you need a strong legal case. Working with a good lawyer is key. This way, you get the financial help you need during tough legal times4.

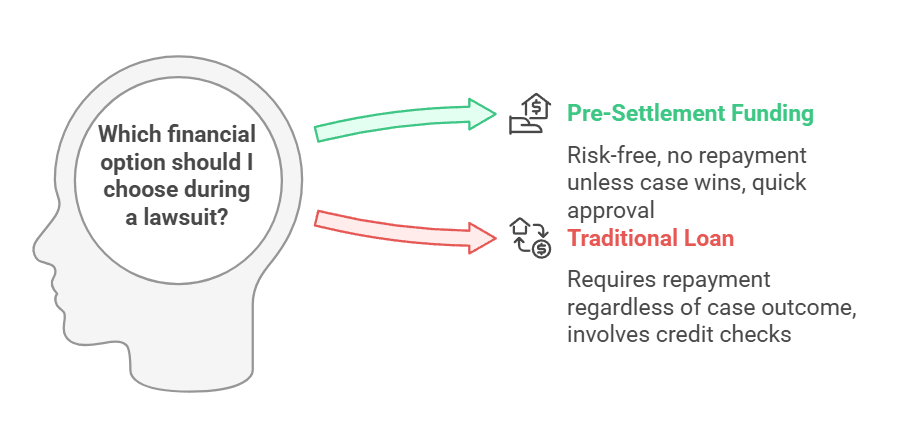

How Pre-Settlement Advances Differ from Traditional Loans

When you’re in a tough spot financially during a lawsuit, knowing about non-recourse funding can be a big help. Pre-settlement advances are different from regular loans in important ways. These differences can change how you handle your money5.

The main difference is how they work. Unlike regular loans, pre-settlement funding is a risk-free financial solution. It doesn’t add more stress to your finances5.

The Non-Recourse Advantage

One big plus of non-recourse funding is that you only pay back if you win your case6. This is a big relief compared to regular loans, which you must pay back no matter what.

- No credit check required

- No collateral needed

- Repayment contingent on case success5

“Pre-settlement funding isn’t a loan – it’s an investment in your legal journey.”

Companies in the legal funding field are getting more popular. For example, Express Legal Funding offers funding from $500 to $500,000 quickly7.

| Feature | Pre-Settlement Funding | Traditional Loan |

|---|---|---|

| Repayment Requirement | Only if case wins | Mandatory regardless of outcome |

| Credit Check | Not Required | Always Required |

| Processing Speed | 24-48 Hours6 | Several Days to Weeks |

Getting financial help might be closer than you think. Knowing these differences helps you make better choices about lawsuit funding7.

The Role of Legal Representatives in Funding

Your attorney plays a key role when you’re looking for pre-settlement funding. They do more than just defend your case8.

Getting a lawsuit loan often needs your lawyer’s help. They must give detailed information about your case to lenders8.

Essential Attorney Involvement in Funding

- Verify lawsuit documentation

- Review funding agreement terms

- Confirm case strength and potential settlement value

- Provide critical case information to lenders

Lenders need your lawyer’s help to move forward. Without them, getting a loan is almost impossible8.

“Your attorney isn’t just your legal champion – they’re a crucial player in securing your financial support during litigation.”

Attorneys can take a big chunk of your settlement money. They often take up to 40% of what you win8.

| Attorney Action | Impact on Funding |

|---|---|

| Case Verification | Critical for Lender Approval |

| Settlement Potential Assessment | Determines Funding Amount |

| Documentation Review | Reduces Lender Risk |

Your lawyer’s help is crucial for getting the funding you need. Talking openly about your financial needs is important for success9.

The Importance of Case Strength in Approval Decisions

Understanding what lenders look for in pre-settlement funding is key. Your case’s strength decides if you get the financial help you need during tough legal times.

Clear Liability Requirements

Getting lawsuit funding depends on showing clear liability. Lenders check the defendant’s role in your case with detailed documents. Your proof of liability is crucial for funding approval10.

- Collect police reports

- Gather witness statements

- Obtain expert testimonies

Documentation of Damages

Showing damages is vital in funding applications. Lenders need proof of injury to see the full financial effect of your case11.

- Medical treatment records

- Treatment invoices

- Documented lost wages

Insurance Coverage Verification

Insurance coverage reassures lenders. Checking the defendant’s policy is key to funding potential12. Strong insurance documents boost your approval chances.

We've created this table to help you compare different online loan matching services. These services can connect you with a network of lenders, offering various types of loans to fit your needs.

In this table, you'll find key details such as the loan provider's name, the range of loan amounts they can help you find, typical approval and payout speeds, and the types of loans they offer.

To get a complete picture, including details about potential costs like APRs and fees, specific credit requirements, the application process, security information, and other considerations, we encourage you to visit the related service's page directly.

Please remember that these services are not direct lenders, so your specific loan terms will be determined by the actual lender, and those details can vary. Please note that we may receive an affiliate commission if you click on links or apply through this page, however, this does not influence our recommendations.

We hope this comparison table helps you in your search!

“Your documented damages are the financial narrative that convinces lenders of your case’s merit.”

Presenting a clear view of liability, damages, and insurance boosts your funding chances.

Property Documentation and Evidence Requirements

Getting pre-settlement funding is complex and needs careful attention to medical records. Your medical history is key to your funding application. It shows how your injury affects you and how much you might get in compensation.

For pre-settlement loans, having detailed medical records is crucial. Lenders check these records closely to see if your case is strong.

Critical Medical Documentation Components

- Detailed medical records showing full treatment history

- Diagnostic reports and specialist evaluations

- Prescription documentation

- Therapy and rehabilitation records

- Proof of ongoing medical expenses

Your medical records tell a story – of injury, recovery, financial impact, and future medical needs. Funding providers need to see your whole medical journey.

| Documentation Type | Importance Level | Impact on Funding |

|---|---|---|

| Hospital Records | High | Critical for establishing injury severity |

| Treatment Invoices | High | Demonstrates financial burden |

| Specialist Reports | Medium | Provides expert medical assessment |

“Incomplete medical documentation can derail your funding application faster than you can imagine.”

Your financial recovery starts with thorough medical records. Make sure your healthcare providers document every interaction13. Each document helps your case and boosts your chance of getting the funding you need14.

Alternative Options When Funding is Denied

When your pre-settlement funding application gets rejected, don’t give up. There are other ways to get the financial help you need. These alternatives can support you during tough legal times15.

Personal loans are a good option after loan denial. Credit unions and online lenders often have better terms than banks. Low-interest credit cards can also help, offering quick relief while your case goes on16.

Family and friends might be there to help too. Home equity agreements are another smart choice, needing less strict credit checks15. Studies show that alternative lenders might approve more people than banks15.

Your best move is to work closely with your lawyer. Find out why you were denied funding, get more documents, and show clear fault. Remember, a denial today doesn’t mean you won’t get help tomorrow. It’s just a temporary setback on your way to justice.

Frequently Asked Questions

Why do lenders deny pre-settlement loans?

Lenders deny pre-settlement loans for various reasons primarily related to risk. If your case appears weak, liability isn’t clear, or damages are too low, they may pass. They also evaluate insurance coverage, legal representation, and your financial need to assess the likelihood of recovering their funds plus profit. A strong lawsuit is essential for approval.

What makes a strong case for pre-settlement funding?

A strong case for pre-settlement funding requires clear liability, meaning it's obvious who is at fault. It also needs significant damages, such as medical bills, lost wages, and pain and suffering. Solid documentation, including medical records, police reports, witness statements, and expert opinions, is crucial to back up the claim and improve your chances of approval and the settlement loan amount.

How does insurance coverage affect pre-settlement loan approval?

Insurance coverage is very important for approval. Lenders need assurance that funds are available for collection if you win. Low or no defendant insurance is a red flag. The policy limits are also assessed; if coverage is too low for your damages, you might be denied. Having uninsured/underinsured motorist coverage can be beneficial.

Can my lawyer’s experience impact my pre-settlement loan application?

Yes, an experienced attorney specializing in personal injury law significantly impacts your application. Lenders prefer working with lawyers with a track record of success in building strong cases, negotiating with insurance companies, and maximizing settlements. Your attorney must also agree to the pre-settlement loan and sign a letter of protection.

What kind of documentation do I need for a pre-settlement loan?

You need comprehensive documentation to prove your case. This includes all medical records and bills, police reports, accident reports, employment records showing lost wages, and any other evidence supporting your claim. The more documentation you provide, the easier it is for lenders to assess and approve your loan.

What are the fees and interest rates on pre-settlement loans?

Pre-settlement funding is not cheap. Fees and interest rates, often structured as a percentage of the settlement in a non-recourse purchase agreement rather than a traditional loan, vary widely depending on the lender, case strength, and advance amount. You should always obtain full details in writing before signing anything.

What happens if I lose my case?

Pre-settlement loans are typically non-recourse. This means if you lose your case, you are generally not required to repay the advance. The lender assumes this risk, which is why they are selective about the cases they fund.